By Michael Swanson, Ph.D., Chief Agricultural Economist, Wells Fargo, Agri-Food Institute

(This article is reprinted with permission from Wells Fargo.)

China has had an outsized influence on U.S. agriculture for the last two decades. As the second largest economy in world1 and tied with India for the largest population,2 China has entered the Big Three of U.S. agricultural exports.

China, Mexico, and Canada account for one out of two dollars of U.S. agricultural exports.3 This important relationship raises many questions for U.S. agricultural producers and agribusinesses. Will China remain a strong importer of U.S. agricultural products? How much more growth should we expect from the world’s largest food producer and consumer? How will the changing demographics in China influence their production and importation of global agricultural products? It helps to go back and look at the historical changes to anticipate the future changes.

Sometimes it surprises people to learn how small China’s economy was prior to its reorientation towards a market-led expansion in the 1980s. Even then, Chinese exponential growth did not really start until the early 2000s. Given the opaque nature of China’s statistical reporting, there are many valid questions about what the numbers really mean, but there is no denying the measurable impact on the global economy.

We can look at the dollars of agricultural exports to China over the same period to see the impact that the economic growth had on demand for U.S. and the global agricultural products.

According to the U.S Department of Agriculture (USDA) database, the U.S. exported $4 billion of agricultural and food products to China in 2002. By 2012, thanks to explosive growth in Chinese demand and a surge in commodity prices, Chinese exports had grown to $32 billion. No other country demonstrated that type of growth to the U.S. and global agricultural producers. In 2022, the U.S. exported $42 billion in agricultural and food products to China, representing a new record. This was, once again, tied to a surge in commodity prices. Two-thousand-twenty-three saw that value drop by $9 billion to $33 billion in exports. The two factors driving this were the drop in commodity prices along with softer demand from China due to an economic slowdown.

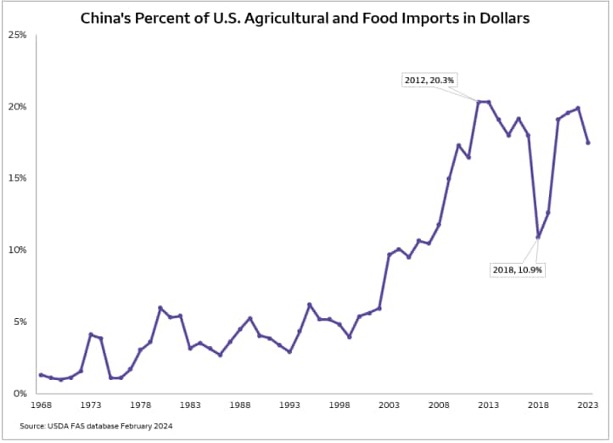

A good way to account for the volatile commodity pricing involves looking at China’s percentage of U.S. agricultural exports. This depicts China’s growing influence while accounting for other countries growth and prices.

Even prior to their explosive economic growth, China had years where it accounted for up to 5 percent of total U.S. agricultural exports. However, those years were the exceptions, with most years being around 2-3 percent. This changed significantly in the early 2000s with China steadily growing its influence as a share of U.S. agricultural exports. Even factoring in the surging commodity prices of 2012, which impacted all U.S. export markets, China rose to its peak at 20.3 percent. Since then, China’s share has plateaued at about 18-19 percent, excepting the trade dispute years of 2018 and 2019, when its share dropped to about 12 percent. Many agricultural producers recognize a possible repeat of this disruption as U.S. and Chinese trade relationships come under additional geopolitical pressures.

Another important way to look at this key trade relationship is from the Chinese side of the trade. Exactly, how important is the U.S. to China? Can China replace the U.S. with other suppliers? Which products can it live without? This helps calibrate the risk from the Chinese perspective.

China is both the world’s largest agricultural producer and consumer. According to the data from the Food and Agriculture Organization of the United Nations (FAO), in 2021, China’s agricultural production value was 4.6 times greater than the U.S. value. This is roughly proportionate to the population differential at 4.2 times for the same period.

Taking into account the value of U.S. agricultural exports to China against their gross production value for agricultural commodities changes the scale considerably. U.S. exports rose from approximately 1.5 percent of Chinese agricultural production in the early 2000s to a peak of 2.5 percent in the most recent years.3 The trade dispute saw that drop to about 1.2 percent in 2019.3 However, it recovered to 2.4 percent in 2021.3 All in all, the Chinese have considerable capacity to absorb the loss of U.S. agricultural exports. Between other suppliers such as Brazil and domestic production, China doesn’t rely on the U.S. for its food supply. There are certain commodities such as almonds that are not easily replaced given the U.S. dominance in production and exports, but these are more of an irritant than a game changer for the trade dispute (at least from the Chinese side).

The takeaway is that China’s growth in agricultural imports has plateaued. Fortunately, it appears that China is not looking to diversify away from the U.S., and it can afford the products that the U.S. exports. However, the 2018 and 2019 trade dispute proved that China can disrupt U.S. agricultural exports without its population feeling undue internal pressures. This means that the risk of a repeat episode should be considered a probable event. The timing and probability are not things that models can predict because political timing is the dependency, and this remains a guessing game for everyone.

ENDNOTES:

1 FAOSTAT February 2024 in reference to USD based estimates for 2022

2 FAOSTAT February 2024 estimates for 2024

3 USDA GATS February 2024 for 2023

RO-3404284

LRC-0224

ABOUT THE AUTHOR

Michael Swanson, Ph.D., who joined Wells Fargo in 2000, is the chief agricultural economist within Wells Fargo’s Agri-Food Institute. He is responsible for analyzing the impact of energy on agriculture and strategic analysis for key agricultural commodities and livestock sectors. His focus includes the systems analysis of consumer food demand and its linkage to agribusiness. Additionally, he helps develop credit and risk strategies for Wells Fargo’s customers and performs macroeconomic and international analysis on agricultural production and agribusiness.

Previously, Swanson worked for Land O’ Lakes and supervised a portion of the supply chain for dairy products. He also had worked for Cargill’s Colombian subsidiary, Cargill Cafetera de Manizales S.A., with responsibility for grain imports and value-added sales to feed producers and flour millers. Swanson received undergraduate degrees in economics and business administration from the University of St. Thomas, and both his master’s and doctorate degrees in agricultural and applied economics are from the University of Minnesota