This article will be featured in the next GAI Gazette, Volume 7, Issue 2, which will be distributed digitally in conjunction with the Global AgInvesting Europe event, which will be held virtually on December 7-8, 2020. Join us for this 11th annual event to gain valuable insight and learn best practices from the expert speaking faculty. See the agenda, and learn more and register.

By Kenneth Scott Zuckerberg, CoBank

Cooperatives have a long, proud history and remain the largest and most important providers of farm supplies to America’s crop farmers. However, challenging fundamentals and disruptive forces – in place prior to COVID-19 – are pressuring the business model.

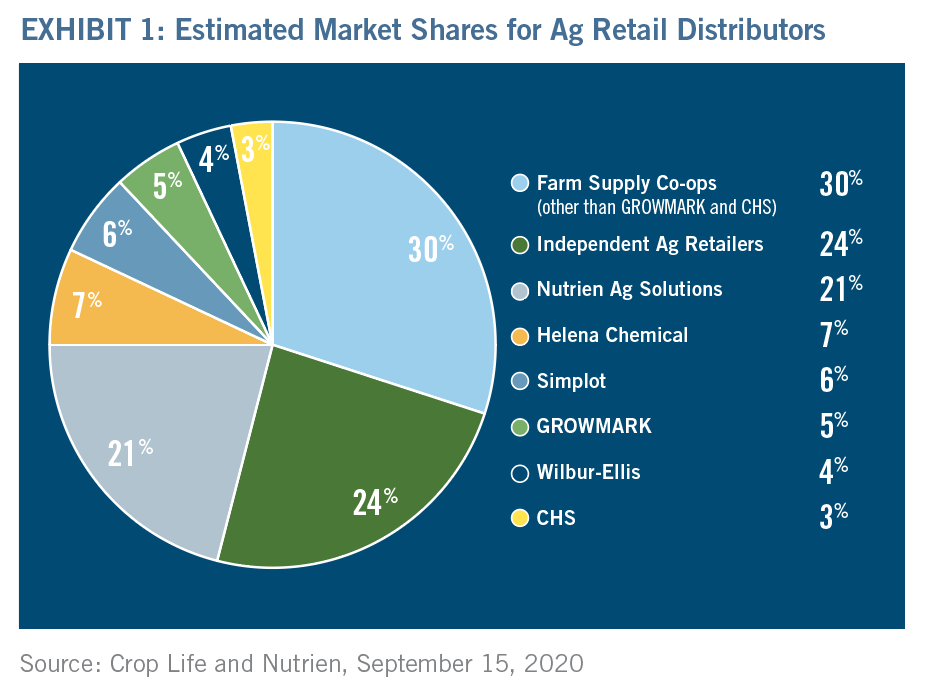

Farm supply service cooperatives remain the dominant form of input distribution in North America. However, in recent years competition has intensified with noncooperative distributors (independents) as well as Nutrien Ag Solutions, a vertically integrated crop inputs supplier (Exhibit 1). Several competitors have differentiated themselves with integrated digital farming offerings that leverage modern information technologies such as data analytics and AI (artificial intelligence).

Beyond the market share battle, farm supply co-ops’ margins are being squeezed by customer pressures and macro variables. On the former, low grain prices since 2014 have weakened farmer income and cash flow, which has impacted farmer input purchase decisions. On the latter, margins for fertilizer and crop protection chemicals have contracted due to competition, plentiful supplies, generics and alternatives. In the case of fertilizer, lower margins from carry (i.e., buying nutrients when cheap during the summer growing season and reselling product at higher prices during the fall and spring) have largely evaporated.

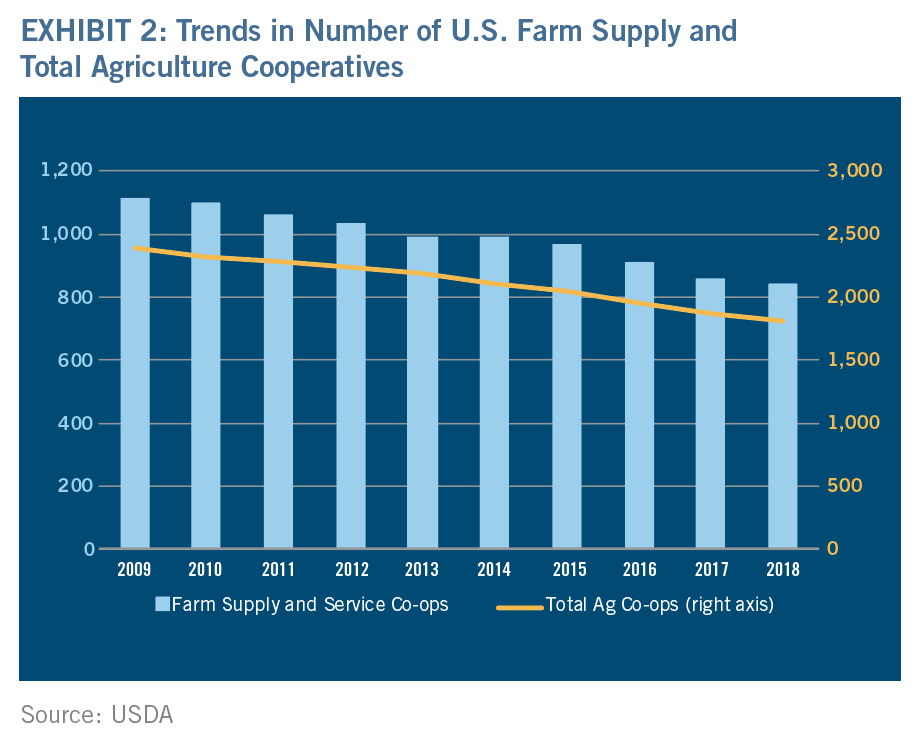

All the while, the outlook for farmers and the farm supply cooperatives that serve them is stressed by growing competition from other major farming regions (namely Argentina, Brazil, Ukraine, and Russia) and a generally strong dollar relative to the currencies of our export competitors. The cumulative effect of industry pressures has been a 24 percent decline in both the number of U.S. farm supply cooperatives and total U.S. agriculture cooperatives since 2009 (Exhibit 2).

Read more in the expanded report.

About Ken Scott Zuckerberg

Kenneth Scott Zuckerberg is a lead analyst and senior economist in CoBank’s Knowledge Exchange division, where he focuses on the grains, farm supply, and ethanol sectors.

Zuckerberg brings more than 30 years of diverse experience spanning securities analysis, investment management, and banking. Prior to joining CoBank, he served as a senior vice president and sector manager for Wells Fargo, working with the bank’s Food and Agribusiness Industry Advisors Group, and previously held a similar role at Rabobank U.A. Earlier in his career, Zuckerberg founded Carlan Advisors LLC, an independent research and consulting firm. Prior to that, he was a senior equity analyst at Lazard Asset Management, Keefe, Bruyette and Woods, Inc., and Smith Barney, Inc. (now Morgan Stanley).

Zuckerberg brings more than 30 years of diverse experience spanning securities analysis, investment management, and banking. Prior to joining CoBank, he served as a senior vice president and sector manager for Wells Fargo, working with the bank’s Food and Agribusiness Industry Advisors Group, and previously held a similar role at Rabobank U.A. Earlier in his career, Zuckerberg founded Carlan Advisors LLC, an independent research and consulting firm. Prior to that, he was a senior equity analyst at Lazard Asset Management, Keefe, Bruyette and Woods, Inc., and Smith Barney, Inc. (now Morgan Stanley).

Zuckerberg earned a bachelor’s degree in finance from the University of South Florida and is a graduate of the University of Pennsylvania – Wharton Executive Education General Management Program (GMP). He is an Accredited Investment Fiduciary AIF®, an Accredited Financial Analyst AFA®, and completed Levels I and II of the Chartered Financial Analyst (CFA®) program. He is currently enrolled in the Master in Law program at the University of Pennsylvania Carey Law School.