By Gerelyn Terzo, Global AgInvesting Media

In its newly released progress report, Tracking Net Zero and Climate Positive Investment Strategies, the Oregon State Treasury outlined how the Oregon Public Employees Retirement Fund (OPERF) is managing emissions intensity across the portfolio while continuing to pursue competitive returns. Real assets serve as a linchpin for the strategy, housing the fund’s climate-positive investments alongside more traditional holdings. Within that allocation, climate-positive holdings have nearly doubled, rising from $1.2 billion in 2022 to $2.4 billion as of mid-2025. Notably, that segment has also emerged as the portfolio’s strongest-performing real asset category, delivering roughly 20 percent earnings over the past five years.

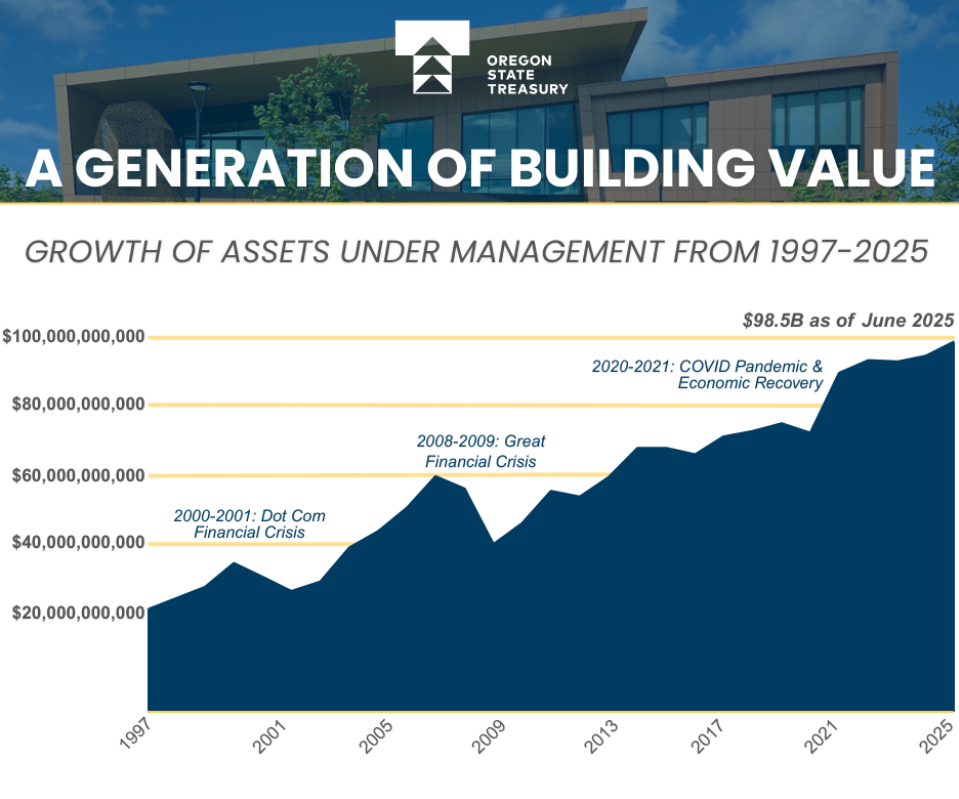

Boasting total assets under management of $100 billion, OPERF’s investment strategy is two-pronged. On one side, OPERF has focused on increasing exposure to climate-positive holdings, an effort that is paying off, with those investments roughly doubling since 2020 and outperforming carbon-intensive assets in the portfolio. On the flip side, the fund has set clear portfolio-wide emissions targets, targeting the slashing of emissions intensity by 60 percent by 2035 and reach net zero by 2050. Together, the approach combines capital deployment with emission reduction goals, allowing the portfolio to pursue its climate agenda while maintaining flexibility in how those objectives are achieved.

Oregon state Treasurer Elizabeth Steiner was cited by Oregon Public Broadcasting explaining that real assets represent the most emissions-intensive segment of the retirement investment portfolio, reflecting exposure to windmills, buildings and industrial facilities, where carbon footprints lend themselves to high emissions. That reality has made real assets a focal point for climate strategy. Most of the recent growth in climate-focused holdings has occurred within this bucket, particularly in renewables and lower-emissions infrastructure.

Image Courtesy of Oregon State Treasury

The Treasury has also drawn parallels between long-term investing and agriculture, framing portfolio construction as something that must be cultivated patiently over time. In a recent Ledger feature, officials compared OPERF’s investment approach to farming, emphasizing that planting a single crop may deliver strong results in one season but leaves the farm vulnerable over the long haul. A diversified mix, by contrast, spreads risk, smooths returns and improves resilience across cycles. That analogy reflects how the Treasury thinks about allocating capital across asset classes that behave differently as market conditions change.

The content put forth by Global AgInvesting News and its parent company Arc Network LLC is intended to be used and must be used for informational purposes only. All information or other material herein is not to be construed as legal, tax, investment, financial, or other advice. Global AgInvesting and Arc Network LLC are not a fiduciary in any manner, and the reader assumes the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on this site.