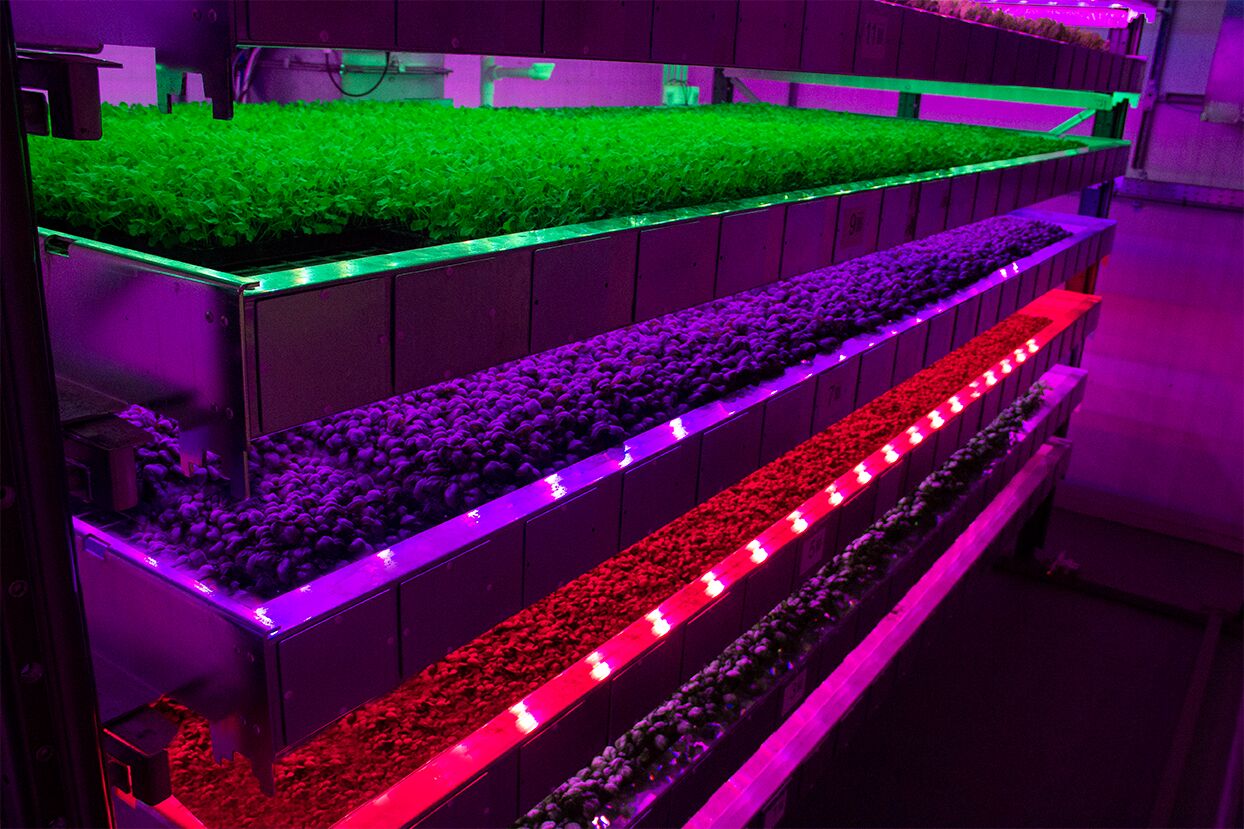

(photo courtesy of IGS)

by Lynda Kiernan

S2G Ventures has led a £5.4 million (US$6.8 million) Series A for Scottish agtech startup Intelligent Growth Solutions (IGS) to advance the company’s ground-breaking automated technology for the indoor farming industry. The Scottish Investment Bank (SIB) and AgFunder also participated in the round.

Based in Dundee, IGS offers what it refers to as a “plug-and-play” IoT-enabled vertical farming system. The startup’s novel technology is designed to address some of the widely-faced economic and operational challenges in the vertical farming industry, including scarce labor, the cost of power, and the difficulties of consistency in production at scale.

To demonstrate the applicability and efficacy of its patented platform, IGS opened a demonstration vertical farming facility in August 2018 (the first vertical farm in the country) to showcase its modular, scalable, and flexible products that give vertical farmers the ability to overcome barriers to growth. Included in the patented electric, electronic, and mechanical platform are self-adjusting LEDs that can change with the needs of different crops; automated, machine-controlled trays; and software controlled watering systems.

By integrated IGS’ system, vertical growers have the potential to reduce energy usage by 50 percent, reduce labor costs by 80 percent, and realize yields that are 225 percent larger than traditional under-glass agriculture. A video of IGS’ demonstration farm can be viewed here.

“Indoor agriculture production is at a tipping point. Grocery and food service firms have never been more interested in adopting this in their future supply chain,” said Sanjeev Krishnan, managing director of S2G Ventures.

“Cost and quality of product will be critical to scale this adoption,” noted Krishnan. “IGS’s revolutionary technology has proven itself to reduce power consumption, improve ventilation and hence reduce the capital and human costs to deliver fresh and differentiated products to consumers.”

The company plans to use the capital from its first funding round to drive job creation in software development, engineering, robotics, and automation. The company is also planning for further product development including advances in innovation in AI, IoT, and big data, and will be building out its global marketing, sales, and customer support initiatives across three continents.

“We are delighted to support the continued development of IGS as it looks to take its technology to the global marketplace,” said Kerry Sharp, director of the SIB. “The company has been account managed by Scottish Enterprise since 2014 and has received both financial and non-financial assistance covering innovation and R&D as well as supply chain management and international market entry. The company has made significant progress over the last 12 months and has assembled an impressive team with a clear focus on taking the IGS offering to an international market.”

A Dynamic Field in Vertical Farming

It was not long ago that vertical farming was viewed as not being an investable asset class. However, since 1982, 24 million acres of U.S. farmland have been lost to development, and the loss continues at a rate of 40 acres of farm and ranch land every hour, according to the American Farmland Trust. More specifically, the California Climate & Agriculture Network states that California, one of the top-producing agricultural states in the country, has lost an average of 50,000 acres of farmland each year for the past 30 years due to urbanization and development.

It is the ability of indoor farming to meet and alleviate these challenges that is driving the market to be expected to exceed a value of US$6 billion by 2022. And as technology matures – allowing the industry to scale up and prove out how it can answer multiple challenges, from traditional long transport systems, to food waste, to water conservation, to food contamination, to growing food in urban food deserts – so have the funding rounds.

Earlier this month Britain’s Ocado, the world’s largest online grocery retailer, made its first venture into vertical farming with a pair of agreements representing a total investment of £17 million (US$22 million).

Together with the Netherlands-based Priva Holding BV, a leading horticulture-focused provider of technology solutions, services, and automation systems, and U.S.-based 80 Acres Farms, a top indoor vertical farming company operating multiple farms producing tomatoes, cucumbers, peppers, leafy greens, and fruits such as strawberries, Ocado is launching Infinite Acres, a provider of integrated tech solutions for the indoor vertical production of the highest quality produce on a year-round basis.

Ocado also announced its acquisition of a 58 percent stake in UK-based Jones Food Company (JFC), the largest operating vertical farm in Europe.

Located in an industrial park in Scunthorpe, England, JFC’s facility hydroponically produces 10 varieties of leafy green herbs including coriander, basil, dill, chives, and mint.

Within days, urban farming startup InFarm, which is based in Berlin, Germany, announced it had raised $100 million in equity funding and debt financing through a round led by London-based Atomico. Existing investors Balderton Capital, Astanor Ventures, and Cherry Ventures also participated, while TriplePoint Capital provided nearly all of the debt.

Earlier this year Canadian startup INNO-3B announced it had raised C$6 million (US$4.5 million) in seed funding through a round led by Ecofuel Fund. And echoing IGS’ course, INNO-3B plans to “implement a demonstration of its technology in the context of real time operations”, which is expected to accelerate the marketing momentum of its solutions, and to ensure constant support for its customers.

Two of the largest funding rounds in the space were announced within the past 24 months, when San Francisco-based indoor vertical farming startup Plenty raised a $200 million Series B led by SoftBank Vision Fund in July 2017, and high-tech, indoor, ‘post organic’ vertical farming startup Bowery Farming announcing it had raised $90 million through a financing round led by Alphabet Inc.’s GV in December 2018.

– Lynda Kiernan is Editor with GAI Media and daily contributor to GAI News. If you would like to submit a contribution for consideration, please contact Ms. Kiernan at lkiernan@globalaginvesting.com