September 4, 2019

This is the fifth article in an eight-part series published by GAI News that examines eight existing trends set to alter the structure of our global food system. Join us each month for a new installment, and be sure to read the first four articles here: Part I, Part II, Part III, Part IV.

By Jeremy Stroud, Bonnefield Investment Analyst, and Michael DeSa, Founder, AGD Consulting

With the advent of sprawling wildfires throughout Brazil’s Amazon rainforest, politicians, businesses, and investors in timber and agriculture within the region are prompted to sincerely consider the ramifications of their asset management practices and investment decisions. While many forest fires occur as a natural and beneficial reaction of the local ecological cycle, this is not the case for the Amazon. Despite the fact that these fires have taken place in Brazil’s dry season, INPE, the Brazilian national space agency, has documented an 83 percent increase in fires since the previous year,(1) while deforestation has increased by 67 percent since January 2019.(2) The El Niño dry period likely contributed to the severity, although INPE has directly connected these fires with the recent onslaught of deforestation and greenfield agricultural development.(3)

![]() The Amazon basin supports over half the world’s tropical rainforests and currently acts to offset approximately one quarter of human-caused greenhouse gas emissions.(4) Events taking place in Brazil serve as a vivid reminder of weather volatility and its intersection with global agriculture. This issue explores severe weather events, natural disaster risk in farming regions and the implications for investors. The findings reaffirm similar themes in past installments: those who have the opportunity to invest in land and water resources also bear the responsibility to allocate their capital towards environmentally resilient regions and strategies.

The Amazon basin supports over half the world’s tropical rainforests and currently acts to offset approximately one quarter of human-caused greenhouse gas emissions.(4) Events taking place in Brazil serve as a vivid reminder of weather volatility and its intersection with global agriculture. This issue explores severe weather events, natural disaster risk in farming regions and the implications for investors. The findings reaffirm similar themes in past installments: those who have the opportunity to invest in land and water resources also bear the responsibility to allocate their capital towards environmentally resilient regions and strategies.

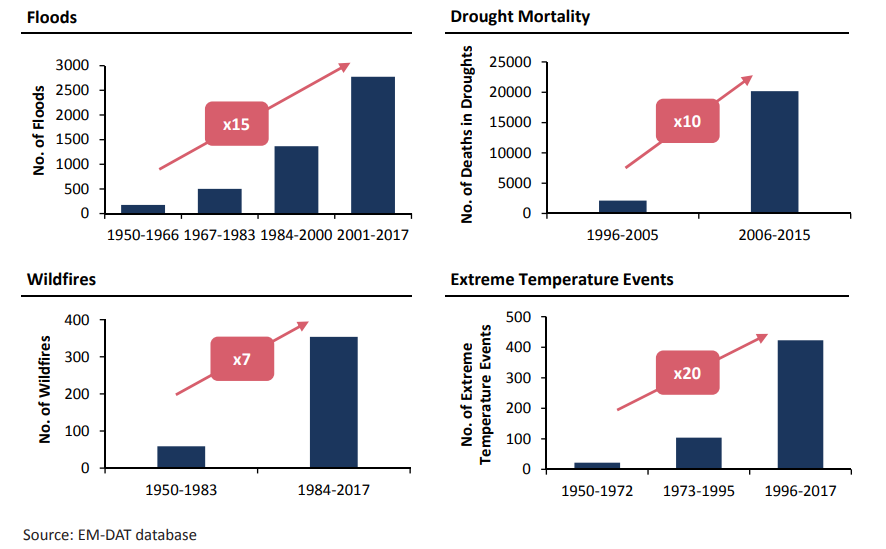

While we previously wrote about global warming, carbon emissions, and the long-term growth of global surface temperatures, this article reflects the opposite side of the climate change coin. It pertains to the immediate consequences of severe weather events and natural disasters. As temperatures increase, additional moisture is retained in the air which leads to heavier downpours and a higher frequency of extreme precipitation events.(5) On the other hand, warmer weather also accelerates the pace of evaporation, leading to circumstances where droughts and wildfires may prevail. Agriculture has always succumbed to the forces of unsettled weather behavior, although trends project increased volatility in each of the next several decades. Extreme events are accelerating at a tremendous pace, and Figure 1 exhibits just how fast it is happening.

Figure 1: Occurrence of Global Natural Disasters(6)

Source: International Disasters Database (EM-DAT), GMO Investments, 2018

According to the UN’s Food and Agriculture Organization (FAO), over 20 percent of economic losses due to natural disasters are absorbed by agricultural businesses worldwide with natural disasters accounting for approximately one quarter of annual crop losses.(7) Beyond losses to farm yields, severe storms and droughts also constrain logistical systems that service the agri-food industry. River traffic throughout the Mississippi River, for example, was reduced significantly after a drought in 2012 narrowed the route. We also witnessed substantial flooding this spring in the U.S. Midwest where farmers experienced delayed planting, destroyed facilities, and increased spoilage for crops in storage.

Although natural disasters are indiscriminate in their movements, each geography faces a different level of risk. Figure 2 depicts each country’s susceptibility to natural disaster risk from the 2018 World Risk Report by the United Nations Institute for Environment and Human Security. It offers insight on a country’s exposure and vulnerability to potential natural disasters by analyzing historical data. The study ranks 173 countries by measuring an average citizen’s probability of being exposed to natural hazards such as floods, storms, droughts, sea level events, and earthquakes.

Figure 2: World Risk Report – Risk of an Extreme Natural Event Leading to Disaster(8)

Source: United Nations – Institute for Environment and Human Security (UN-EHS), 2018

The multi-year United Nations analysis identifies Central America, West and Central Africa, Southeast Asia, and Oceania as the areas with the highest global disaster risk. It indicates that while many countries are improving their disaster preparedness, extremes in weather systems are expected to occur more frequently with heightened potential for negative consequences.(9) Although the concern is growing throughout the world, Canada and Europe’s diversified geography and cooler climate position them as some of the lowest risk regions in the world. Countries with robust national emergency management systems have also helped to partially mitigate the devastating effects of severe weather and geological systems.

The Modern Investor’s Response to Catastrophe

The Cambridge Centre for Risk Studies uses a series of scenario analyses to assess the impact of hypothetically likely natural disasters on financial markets and investment portfolios.(10) The study forecasts significant economic consequences for equity markets if any of these events were to occur. For example if Mount Rainier, an active volcano in the state of Washington, were to erupt, the S&P 500 and Dow Jones Industrial Average are expected to suffer a 20 percent loss.(11) Other scenarios that were studied include floods, hurricanes, and earthquakes, and although each have a low probability of occurrence, they collectively exemplify the potential for a large destructive event.

There are few winners in the wake of catastrophe, as production capacity, investor confidence, and local infrastructure all suffer. As such, traditional portfolios consisting of public equity and fixed income assets are particularly vulnerable to natural disaster events due to their global interconnectedness. In the event of an extreme disaster with over US$1 trillion in damages, returns are expected to suffer in a non-linear manner with their risk-tolerance as global markets are perturbed. Investing in a diversified portfolio of real assets such as infrastructure and farmland in low-risk geographies may act to offset economic losses brought forth by severe environmental events and fluctuations.

Investors may also consider allocating capital towards regenerative agricultural practices and land portfolios with disaster prevention infrastructure in place. Regenerative agriculture, which works to increase soil organic matter content, will increase the resilience of soil structures, thereby increasing moisture retention during times of drought and reducing topsoil erosion in heavy downpours.

Recent events have provided all agricultural investors, no matter their exposure to specific geographies, commodities, or strategies, with the opportunity to consider the long-term ecological consequences of their actions. Preservation of capital with positive environmental and economic returns may be achieved with careful due diligence and investment discipline. Critically acclaimed investor, Jeremy Grantham, may have best articulated the matter in his most recent report:

“We’re racing to protect not just our portfolios, not just our grandchildren, but our species. So get to it.”

Continue Reading:

Part VI – An Essential Nutrient: Phosphorus Shortages and Overuse

ABOUT THE AUTHORS:

PRIMARY AUTHOR

Jeremy Stroud is an agricultural investment analyst with Bonnefield based in Toronto, Canada. With a background in international food business, he offers insights on global agri-food and water investments, value chain analysis and economic systems. He has volunteered and worked with a spectrum of primary and vertically integrated agricultural groups in North and South America, Europe and Africa.

CONTRIBUTING AUTHOR

Michael DeSa is the founder/managing director of AGD Consulting, a U.S.-based, strategic advisory and business development firm servicing the agricultural and resource sectors in emerging and OECD markets. His agricultural engineering background, 10-years of project management experience with the U.S. Marine Corps, and agribusiness investment experience make him uniquely qualified to counsel companies throughout the region.

…

[1] Paraguassu, 2018. Reuters. Amazon burning: Brazil reports record forest fires.

2 Spring, 2019. Reuters. Why are the Amazon fires sparking a crisis for Brazil – and the world?

3 Garrett, 2018. In Partnership With Boston University. Strict Amazon protections made Brazilian farmers more productive, new research shows.

4 Exbrayat, Liu & Williams, 2017. Impact of deforestation and climate on the Amazon Basin’s above-ground biomass during 1993–2012.

5 Cho, 2018. Columbia University. How Climate Change Will Alter Our Food.

6 Jeremy Grantham, 2018. The Race of Our Lives, Revisited.

7 Food and Agriculture Organization, 2015. The Impact of Natural Hazards and Disasters on Agriculture.

8Heintze, Hilft, Mann et al., 2018. World Risk Report.

9Heintze, Hilft, Mann et al., 2018. World Risk Report.

10 University of Cambridge, 2018. Cambridge Centre for Risk Studies. Impacts of Severe Natural Catastrophes on Financial Markets.

1[1] University of Cambridge, 2018. Cambridge Centre for Risk Studies. Impacts of Severe Natural Catastrophes on Financial Markets.

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.