By Adam Bergman, Managing Director, EcoTech Capital

Agriculture in the U.S. has been transformed over the last 50 years as small family farms have been swallowed up or replaced by large corporations. The resulting economies of scale have led to farming on an industrial level, with crops optimized for output, and livestock raised for size and milk production, rather than taste and nutrition, and with an increasingly harmful impact to the environment. Additionally, many crops and animals are located in specific regions, including berries, grapes, and leafy greens from Central and Southern California; apples and cherries from Washington State; corn, soy, and wheat from the Midwest; cattle on the great plains; and cotton grown in the Southeast. Nevertheless, we are starting to see the beginning of a more decentralized production system, driven by the growth of indoor farming. While today the focus is on specialty produce, like berries, kale, microgreens, leafy greens, peppers, and tomatoes, there is a path to expanding into other high-value food items.

To be clear, I am not sounding the death-knell for the big agribusinesses, or predicting a fully decentralized food system where most row crops and animals would move indoors. However, there is no doubt that the food & ag supply chain is showing its age and inefficiency in the wake of COVID-19. Retailers and consumers are likely to demand some fundamental changes that will lead to more of our food being grown on a smaller scale and closer to consumers. It might be hard to believe that such a huge transformation could occur in a multi-trillion dollar sector of the economy, with large entrenched incumbents who have little incentive to adopt rapid innovation. However, I believe that many of the same factors that brought about the rapid rise of distributed solar power are present in the food & ag sector (negative environmental impact, inefficient and highly interconnected distribution system, and safety concerns). Other factors that will also drive the movement towards decentralization, such as nutrition and taste, are unique to the food & ag sector. In this article, I will explain how we are seeing the start of decentralization of the agriculture sector and how it will benefit consumers, based on what happened to the power sector earlier this century.

Why Centralized Power?

Back in 1882, when the first commercial centralized power plant started operations in the U.S., it was deemed more efficient to deliver power to a rapidly growing nation from a central location, which could achieve economies of scale to bring inexpensive electricity to homes and businesses rather than a distributed network of power generating sites. During the twentieth century, the U.S. built a large centralized power grid with numerous multi-gigawatt (GW) generation power plants and millions of miles of transmission and distribution (T&D) lines able to deliver cheap energy to virtually all parts of the nation.

Centralized Power Generation:

Source: Platts

Distributed Solar Generation:

Source: Saur Energy

By the early 2000s, the power sector looked very similar to the food & ag sector today – led by a small group of well entrenched incumbents with strong capital bases, extensive distribution capabilities, and a history of moving slowly to adopt new technologies. However, despite all its advantages, the power sector seemed to be out of step with consumers starting to embrace environmental sustainability. Those environmentally-aware consumers had good reason for concern, as much of the energy from fossil fuels burned at centralized power plants is wasted during generation and delivery to end-users, according to the U.S. Environmental Protection Agency.

The Solar Revolution

When I started working with solar companies back in 2004, power was generated almost exclusively by fossil fuels, nuclear, and hydro. There had been less than 1 GW of solar installed globally according to the International Energy Association (IEA). Since then, the power sector has moved toward more decentralized power generation, due to the rapid adoption of both residential and commercial & industrialized solar power. It is easy to understand why distributed solar has been gaining popularity, given that its cost has dropped from almost $8.00 per watt installed in 2003 to under $2.00 per watt today, according to the IEA. Furthermore, innovative financing options eliminated prohibitively expensive upfront pricing to customers and spread the cost over the 20-year life of the solar panel. Even with these significant price reductions, no one could ever have imagined that in less than two decades, solar would become the largest source of new power generation globally. In fact, cumulative distributed solar installations globally reached over 200 GW in 2018, an almost 50 percent compound annual growth rate over the past 15 years, according to the IEA.

In contrast, traditional energy sources are facing growing headwinds. Fossil fuels like coal and natural gas are increasingly unpopular with consumers and politicians concerned about climate change. Nuclear power was positioned for strong growth, but following the Fukushima nuclear accident in Japan in 2015, many nuclear power stations have been shuttered, and plans for new nuclear power plants face strong public opposition. Hydroelectric power has come under attack from environmental groups, who have been pushing for hydroelectric power plants and the dams created to support them to be decommissioned due to their impact on local fish and wildlife.

Many people assume that the switch to distributed solar power was driven solely by the growing focus on climate change and the need to reduce harmful carbon emissions. However, there were other key reasons driving the adoption of distributed solar power, including an inefficient and highly interconnected distribution system, and concerns about safety.

Limitations of Central Power Generation Emerge

As the U.S. T&D system, which takes energy from a central generation point to commercial, industrial, and residential customers, ages, it is becoming more unstable and increasingly inefficient. In fact, T&D line losses average about 5 percent of the electricity that is transmitted and distributed annually in the U.S., according to the U.S. Energy Information Administration. Additionally, a substantial amount of the energy created at a central generation power plant is in the form of heat, which typically goes unused and makes centralized generation even more inefficient. As well as improving energy efficiency at central generation power plants, the U.S. Environmental Protection Agency sees opportunities for locating electricity generation closer to end-users to reduce losses during electricity delivery, making distributed solar an even more important solution to our electricity needs.

Although this hasn’t historically been an issue for most consumers, there are increasing concerns about the safety of centralized generation. During the past decade there have been a number of terrible fires throughout California and other western states, caused by high winds bringing down transmission lines. Faced with the high cost of building new transmission lines or the even higher cost of burying new or existing power lines, distributed generation continues to look like a more promising alternative. Furthermore, if there is a breakdown in the generation or T&D system of a centralized power system, it leads to a blackout or brownout for whole towns or regions, whereas a problem with distributed solar just impacts a single user or a small group of customers. As an example, a major outage knocked out power across the eastern U.S. and parts of Canada on August 14, 2003 when 21 power plants shut down in just three minutes. Fifty million people were affected, including major metropolitan residents of New York, Cleveland, Detroit, and Toronto. Although power companies were able to resume some service in as little as two hours, power wasn’t restored in NYC for more than a day, which for those living there at the time, including me, made life challenging in the sweltering summer heat.

Industrial Agriculture

Just as the centralization of power generation in the U.S. engendered a manufacturing boom, the industrialization of agriculture enabled farmers to successfully feed a rapidly growing global population. Production efficiencies and an ability to grow food inexpensively have reduced the share of U.S. disposable personal income spent on food by over 40 percent during the past 55 years, according to the U.S. Department of Agriculture. Yet the characteristics that made industrial agriculture so successful, including economies of scale (i.e. large-scale monoculture) and the growing use of crop inputs (chemicals, fertilizers, pesticides, and genetically modified seeds) to increase yield, have led to a backlash from today’s consumers. This mirrors the way consumers rebelled against the lack of choice of power providers two decades ago, when they turned to distributed solar and brought power generation into their own communities. The backlash against industrial agriculture has generated a growing market for the indoor farming sector, as consumers look for fresher, healthier, tastier, and more sustainable foods.

What Do Indoor Farms Look Like?

There are two types of indoor farms: greenhouses, which use sunlight as at least part of their energy source; and vertical farms, which use artificial light, typically LEDs, and no sunlight. Greenhouses are a well-established technology, having been used for growing crops indoors for over 150 years, although many in operation currently lack the latest technology innovations. Greenhouses commissioned today, though, have the latest technologies, including automation, data analytics, energy efficient heating, ventilation, and air conditioning (HVAC) & lighting systems. Thus, coupled with economies of scale, new greenhouses have the potential to become cost competitive with organic produce, to achieve profitability. In contrast, vertical farms, which utilize new technology and have mostly proliferated as a result of the rapidly declining prices of LED lights, have yet to be proven profitable. Nevertheless, vertical farms offer tremendous opportunities as seed companies develop genetics to optimize growing conditions, including the replacement of sunshine with more reliable and predictable LED lights. Such controlled indoor environments provide significant advantages compared to the outdoor field, which is subject to the whim of Mother Nature.

Even using the latest energy efficient lighting and HVAC technologies, indoor farms use significantly more power than traditional farms to grow crops. Furthermore, many indoor farms are pulling power from the grid, which likely means they are using significant amounts fossil fuel. Although most consumers believe that buying more locally sourced produce will have a smaller carbon footprint, this might not in fact be the case. Happily, by switching to distributed solar power, indoor farms benefit from a cost-effective energy source and more environmentally friendly products. As consumers demand more information about the carbon footprint size on product labels, indoor farms will need to invest in technologies, such as solar, that allow their products to appeal to the new generation of eco-consumers.

Greenhouse

Source: Total Energy Group

Vertical Farm

Source: Fluence Bioengineering

Going forward, it will be essential for greenhouses and vertical farms to continually integrate the latest automation and robotics. The importance of this has been shown by numerous COVID-19 outbreaks at farms, food processing, and food distribution centers where working conditions make social distancing a challenge. Advances in automation and robotics should enable indoor farms to decrease production costs, as labor, particularly in more urban areas, had become very expensive, and a potential impediment to reaching cost parity with food grown outdoors. Just as distributed solar adoption increased rapidly as technology innovations and economies of scale drove down costs – both for building new solar manufacturing plants as well as solar panels – the indoor farming sector needs to ensure that it continues to focus on the bottom line for itself and its consumers. The solar sector also took advantage of lower financing rates to provide a cost competitive product to consumers, which occurred once solar manufacturers achieved scale and profitability and their technology had been proved over multiple years to achieve stated performance metrics. Today, the indoor farming sector is at an inflection point and needs to minimize costs and reach profitability. This is the only way to ensure that companies can raise less expensive debt (corporate and project) to grow their operations, otherwise they will be forced to raise much more expensive equity capital, which will stifle long-term growth.

Food Waste is a Growing Problem

Power stations are typically built far away from large population centers, just as field-grown crops are grown on farms far from the end consumer, which means that they both require substantial networks to get their product to the customer. However, a growing number of consumers want to know how far their food has had to travel to reach their plate. They are choosing to shop locally, where they can. For this reason, we are seeing indoor farms popping up in and around major East coast and Midwest urban areas, including Baltimore, Boston, Chicago, New York City, Providence, and Washington DC, which are the areas furthest away from where produce is typically grown.

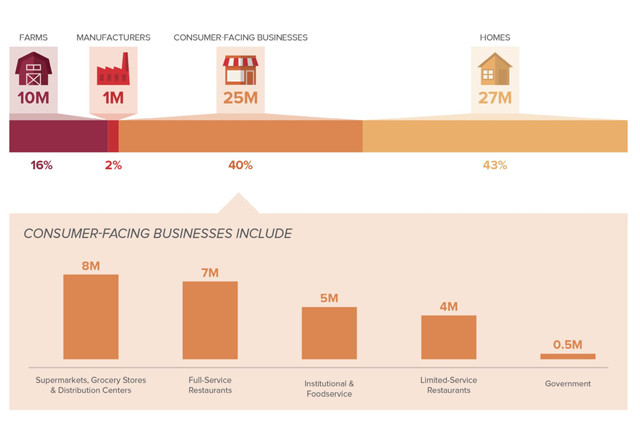

In much the same way that power stations utilize fossil fuels inefficiently, and fail to turn the heat generated into usable energy, traditional food sector methods create a large amount of spoilage and wasted food. The United Nations’ Food and Agriculture Organization estimates that, with over 30 percent of global food production ending up as food waste, it is $2.6 trillion dollar issue. When I visited a leafy greens packaging facility, I witnessed food waste firsthand. I was surprised to see over 20 percent of the outdoor-grown leafy greens being thrown away as they had already wilted in the time it took for them to go from the field to the packing plant. Indoor farms package their produce on site and quickly deliver to the food service sector (hotels, restaurants, schools, and stadiums) and retail sector (grocery stores, online sellers, supermarkets) so the food lasts longer. According to ReFED, a nonprofit committed to reducing U.S. food waste, over 80 percent of food waste occurs at food service and retail locations as well as consumers’ homes so, the quicker food gets to its destination, the less likely it will have to be thrown away. Given that a minimal amount of food spoils in indoor farms, they can sell almost all their output. This makes indoor farms able to be not only more environmentally friendly, but also more cost competitive.

Food Wasted By Weight

Source: ReFED

The highly interconnected distribution system has historically been lauded as a means to efficiently and cost effectively deliver products to consumers. However, today this system also has become a liability, in the same way that the T&D system is inefficient and unable to keep up with the demands being placed on it. COVID-19 has caused a significant increase in food waste even as an increasing number of people are facing food insecurity. This was due to the slow response of the food & ag distribution system after people were forced to stay at home, which caused an overnight drop in demand from the food service sector, while demand rose sharply in the retail sector and also, sadly, at food banks. As the distribution sector was not able to pivot to adjust its supply chains, many farmers were forced to let crops rot in fields, pour milk down the drain, and keep animals in feedlots. In addition, in San Francisco, one of the largest supermarket chains ran short of produce for a couple of weeks in April due to an outbreak of COVID-19 at a key distribution center. Although there wasn’t a shortage of produce, even at other supermarket chains in the city, the supply chain in this and many other instances has failed to deliver consistently to consumers.

How Safe is the Food You Eat?

Consumers also have questions about the safety of their food, given the widespread use of chemicals and pesticides in the production process for most outdoor crops. Their worries have been exacerbated by some recent large jury awards against Bayer’s Roundup herbicide, which is alleged to be a source of cancer, as well as the news that Bayer is contemplating entering into a settlement with existing Roundup litigants. Indoor farms don’t need to use chemicals or pesticides, so their produce has an advantage here.

Another safety concern for many consumers is food-borne illness, which causes 48 million Americans to get sick each year, of whom 128,000 end up hospitalized, and 3,000 die, according to the U.S. Centers for Disease Control. As an example, there have been a growing number of outbreaks over the past couple of years in the produce sector, such as the 2019 major recall of romaine lettuce. Many of the outbreaks are caused by crops getting irrigated by contaminated water due to their close proximity to cattle, or after wild animals got onto crop land. Much of the food-borne illnesses caused by contaminated produce would be eliminated, if the produce was grown indoors.

Other key benefits of indoor farming include year-round production, which is important since even in California, produce is typically harvested no more than nine months of the year, forcing reliance on additional supplies from global and potentially less regulated production areas. Consumers have gotten used to eating berries, cherries, citrus, melons and other high value fruits and vegetables year-round, which indoor farming is able to provide. Also important is the ability to maintain consistency, whereby growers are able to deliver the same size and quality of products to distributors and retailers in every location. This is particularly important as, despite the rapid growth of innovative companies like Full Harvest and Imperfect Produce, most misshapen produce often ends up rotting in fields or in landfills. Furthermore, as indoor farms can make the growing conditions uniform in all locations, they should deliver the same tasting fruit everywhere in the world. Another consideration is that produce grown in indoor farms can thrive, even when the weather conditions outside are too harsh, which will become more critical as the impact of climate change accelerates.

Taste and Nutrition Over Logistics

Following my visit to an indoor farm in the Bay Area less than two hours’ drive from Salinas, California, known as the “Salad Bowl of America”, I started to understand the reason why indoor farming makes sense. The most compelling reason is taste. The indoor grown produce was far superior to the field-grown varieties available in stores and restaurants. Most people are unaware that the seed genetics used in field-grown produce are often selected based on ability to survive transportation over long distances rather than for taste optimization. Most of the produce eaten in the U.S. is grown in California, Arizona, and Mexico, and shipped throughout the country on trains and in trucks. There is no greater evidence of logistics winning over taste than iceberg lettuce. Despite being comprised of almost all water and having little nutritional value, iceberg lettuce was identified as a product able to survive being packed in ice and shipped cross country. I know very few people who are excited to eat iceberg lettuce, yet it remains a staple on many dinner tables throughout the U.S. In the end, better taste might be the most important factor in driving adoption of indoor farming products.

Concerns about industrial agriculture have driven a growing number of customers to look for healthier food. There is an increasingly vocal consumer base wanting foods with clean ingredient labels, that is grown locally, nutritious, sustainable, and from farms that care for the environment, their livestock, and their employees. It is a fact that many consumers associate the development of inexpensive and highly-processed foods with higher fat, sugar, and sodium levels that lead to health issues, including obesity and diabetes. They believe these products to have lower nutritional value and less taste. Younger consumers, particularly Millennials and Generation Z, are more food label-conscious and have shown a willingness to spend more of their disposable income on food that is compatible with their priorities. It is no surprise, therefore, that organic products are growing over five times faster than the non-organic food sector, according to the Organic Trade Association. With indoor farm grown products having a smaller environmental footprint as a result of elimination of pesticides, reduction in water use, and decrease in cross-country transportation, there is a huge opportunity for indoor farms to benefit even more from the same trends driving the adoption of organic products.

Just like the solar sector experienced a significant influx of venture capital investment from 2003 to 2008 due to rising interest in solar power driven by environmental sustainability and government incentives, strong consumer interest in fresher, healthier, more environmentally friendly, and better tasting foods is driving increasing venture capital investment in indoor farming. It isn’t surprising, therefore, that indoor farming companies have raised over $1 billion in equity during the past five years, according to AgFunder. An impressive number of these, including AeroFarms, AppHarvest, BrightFarms, Bowery Farming, 80 Acres Farms, CropOne, Fifth Season, Freight Farms, Gotham Greens, Infarm, Iron Ox, Plenty Ag, Pure Harvest, and Shenandoah Growers, each have raised over $25 million in equity, demonstrating the growing commitment to both greenhouse and vertical farming technologies. Significantly more capital is likely to be raised in the coming years as indoor farms are positioned for rapid growth, and investors bet on new entrants with unique technologies that might result in lower production costs than those of field-grown produce.

Indoor farms will never completely replace outdoor farms and ranches. Staples like carrots, corn, cotton, potatoes, soy, and wheat will still need to be grown outdoors through traditional farming methods, although some niche high-value types of these products could be grown indoors in the future. Today, the advantage of indoor farms is their ability to grow fresher, more tasty, more environmentally friendly, and pesticide-free produce. However, even if the goal for some consumers is for all of their food to be grown locally in indoor farms, the reality is that the current generation of indoor farms grow very few products today, mostly herbs, leafy greens, micro greens, specialty peppers, and tomatoes. As more indoor farms are built and technology innovation advances, particularly around seed genetics, the range and quantity of products they grow will increase, which will be great for consumers. This will likely force incumbent growers to add indoor farmed products to their portfolios, in the same way that energy companies belatedly entered the solar market, or risked losing business to new entrants.

ABOUT THE AUTHOR

Adam Bergman is managing director at EcoTech Capital, where he provides strategic insight and financial advice to senior executives and boards on growth strategies, tactical initiatives, and strategic alternatives. Bergman is a sustainability executive leader with almost two decades investment banking experience in the cleantech sector. As one of the first investment bankers to focus exclusively on cleantech, he is recognized as a leading subject matter expert and is a frequent speaker at industry events and publisher of articles on sustainability. Bergman built an industry leading investment banking practice by connecting food and agriculture executives with foodtech and agtech executives and investors as means to create an ecosystem to help drive adoption of technology and innovative business models throughout the whole supply chain. He works with established food & ag companies, as well as early stage and growth companies focused on ag biotech, alternative protein, animal agtech, automation & robotics, digital & precision ag, fintech, food waste mitigation, indoor farming and supply chain technologies. Additionally, Bergman established the agtech cohort for Wells Fargo’s innovation incubator (IN2), which was launched at the Donald Danforth Plant Science Center in St. Louis, Mo., in 2018. Over the past 20-plus years, he has worked for leading global investment banks, including Deutsche Bank, Jefferies, JPMorgan, Rothschild, UBS and Wells Fargo, and has completed over $12 billion in domestic and international financings and over $25 billion in domestic and cross border M&A, restructuring and strategic advisory transactions.

Adam Bergman is managing director at EcoTech Capital, where he provides strategic insight and financial advice to senior executives and boards on growth strategies, tactical initiatives, and strategic alternatives. Bergman is a sustainability executive leader with almost two decades investment banking experience in the cleantech sector. As one of the first investment bankers to focus exclusively on cleantech, he is recognized as a leading subject matter expert and is a frequent speaker at industry events and publisher of articles on sustainability. Bergman built an industry leading investment banking practice by connecting food and agriculture executives with foodtech and agtech executives and investors as means to create an ecosystem to help drive adoption of technology and innovative business models throughout the whole supply chain. He works with established food & ag companies, as well as early stage and growth companies focused on ag biotech, alternative protein, animal agtech, automation & robotics, digital & precision ag, fintech, food waste mitigation, indoor farming and supply chain technologies. Additionally, Bergman established the agtech cohort for Wells Fargo’s innovation incubator (IN2), which was launched at the Donald Danforth Plant Science Center in St. Louis, Mo., in 2018. Over the past 20-plus years, he has worked for leading global investment banks, including Deutsche Bank, Jefferies, JPMorgan, Rothschild, UBS and Wells Fargo, and has completed over $12 billion in domestic and international financings and over $25 billion in domestic and cross border M&A, restructuring and strategic advisory transactions.

*All views, data, opinions and declarations expressed are solely those of the author(s) and not of Global AgInvesting, GAI News, GAI Gazette, or parent company HighQuest Group.