June 23, 2016

Expert commentary from Finistere Ventures’ Spencer Maughan:

A VC friend of mine recently told me about his new fund and the investment areas of interest. Not surprisingly, genomics was one of the hot areas. As a geneticist and investor, I’m pleased to see the interest. However, when I asked about genomics in agriculture, he told me that there was no good market for genomics in agriculture.

The magnitude of this mistake is hard to underestimate. Of all of the commercial markets for genetics, agriculture is the only arena where every genetic advancement has been commercialized—either directly or indirectly—in a global, multi-billion dollar market. Indeed agriculture is currently the ONLY market selling trillions of complex genomes annually: The global crop seed market.

Genetic Technology in Agriculture

Looking at the evolution of genetic technology from its genesis with Mendel’s peas to population-level analysis of genomes, what we see is that each new breakthrough has first seen large-scale commercial deployment in agriculture. Beyond the fact that it is the only market where genomes are bought and sold, this is also largely due to the power of all genetics being dependent upon the ability to direct sexual exchange – something difficult to do in humans!

The evolution of agriculture is the evolution of genetics. Consequently, it is not surprising (but nonetheless remarkable) that there is such breadth of adoption of genetic technologies in agriculture: recombinant DNA technology (molecular mapping in breeding and genetically modified crops), RNAi (first described in plants[1]) and used for trait discovery and new chemicals[2], gene editing[3] and genomics (next-generation breeding named genomic selection).

How Genetics Creates Value

The value of genetics in these markets is clear. Based on our research, total genome sales are greater than $50B per annum. This figure is much higher if breeding animals are included. Ultimately, the value is based on productivity of the organism. For instance when looking at the USDA’s U.S. corn productivity data-set from the mid-1800s to 2013, an impressive increase is observed, all of which is due to advances in breeding. The largest single genetic breakthrough was the invention of hybrid corn, which took off in the 1940s. Consequently, the best genomes now represent the largest input cost to growers and represent up to 80 percent of the gross margin products to the technology companies that produce them.

Average Bushels/Acre

Value Creation Challenges

Since 1970, there has been a lot more volatility—and most of the large deviations are all points on the unhappy side of the curve—which map to years when there was temperature and water volatility. This exacerbates the yield gap (the difference between optimal yield and the actual yield realized in the field). Ultimately, the only failsafe way to combat increased climate volatility is to breed plants that can withstand it better. Pioneer’s Aquamax corn is an example of the impact that genetic selection can have to mitigate drought.

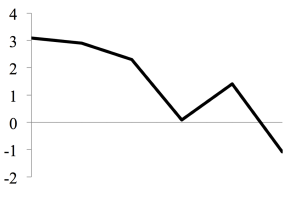

However, we also need to increase productivity. The world is hungrier than ever. And this hunger is centered on protein, which exponentially increases the demand for cereals. It is estimated that yield now needs to increase at double the long-run rate of yield improvement, about 2.4-3 percent per year in order to meet needs in 2050[4]. However, the delta between where we are now and where we need to get to is not ~1 percent, because we are not actually improving at the long-run rate. This is clear when we take the first derivative of the average rate of yield increase for each of the last six decades in corn. In doing this, we are confronted with a sobering output: Yield improvement has been decaying for decades and now is somewhere close to zero.

Percent Rate of Improvement per Decade

New Genetics to the Rescue

While the emerging picture looks grim, there is hope. To date, most breeding has been done using a context that is hundreds of years old. Breeders have integrated diverse data sets and selected the individuals to make products. Despite being an analog approach, this has served agriculture remarkably well. However, one consequence of this is that populations have been limited to decrease the combinatorial matrix of outcomes and breeders have focused on highly influential genes and regions of the genome (so-called high-effect loci). Of course this means that eventually you reach diminishing returns once you have exhausted the search for big influencers of yield in the genetic space with the means at hand.

We can either begin searching in new genetic spaces, use new techniques or do both. Although searching for new variation is appealing, it seems arbitrary to throw out the past effort of breeding regimes if we have new tools to re-energize them. And we do have new tools that can change the paradigm of breeding.

The most significant is a quiet revolution called genomic selection (GS), first described at the University of Melbourne, Australia. GS, as the name suggests, uses sequence data to select genomes. It is predictive and relies on machine learning coupled to advanced data science techniques. The value of GS is that it can optimize all of the little contributors to yield (that previously were ignored) within a population. It is a predictive approach that has been enabled by rapid decreases in cost of compute power and DNA sequencing. It represents the essence of breeding by potentially determining the best code at each position in the entire genome in silico and then recapitulating this genome in the field. The power of this approach completely changes the agriculture game.

Positive Investment Outlook

Taken together, this makes for a compelling investment opportunity:

– There are huge, high-margin, global markets with consistent platforms to scale genetic technologies

– Consumer demand is growing and preferences are changing

– Current technology approaches are not solving the yield pain points

– Toolsets are now cheap enough to use genomics on all crops (computing power and DNA sequencing)

– Agriculture has a much easier regulatory environment than healthcare

– Acquisition appetite is high—incumbents and new entrants are searching for growth and new technologies

Companies in the agriculture sector selling genetic tools and content have always traded at the highest multiples and this will persist. The M&A marketplace is full of precedent companies that have exited in venture timeframes with venture multiples.

Unfortunately, the mythology that genomics does not work in agriculture seems to be influencing entrepreneurs. Only a select few of the genomics companies are currently directing their attention to agriculture. I hope that entrepreneurs (and investors) soon realize that they have been peddled a myth and grasp the opportunity that exists for them in agricultural genomics to build great companies and feed the world.

—

Dr. Spencer Maughan, Bay Area Partner at Finistere Ventures

[1] Bots et al., 2006, Nature

[2] For instance in 2011 Monsanto purchased Divergence a leader in RNAi analysis of nematode trait targets and in 2012 Monsanto bought Beeologics, a leader in RNAi production.

[3] https://www.pioneer.com/home/site/about/news-media/news-releases/template.CONTENT/guid.1DB8FB71-1117-9A56-E0B6-3EA6F85AAE92

[4] Ray et al., (2013) PLoS One

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.