May 22, 2019

Equilibrium Capital has invested $82 million in AppHarvest for the construction of a high-tech, climate-controlled greenhouse project in Morehead, Kentucky.

In addition, ValueAct Spring Fund had led the company’s undisclosed Series A, with existing investor Revolution’s Rise of the Rest Seed Fund, and best-selling author J.D. Vance making a follow-on investment in AppHarvest as part of the round.

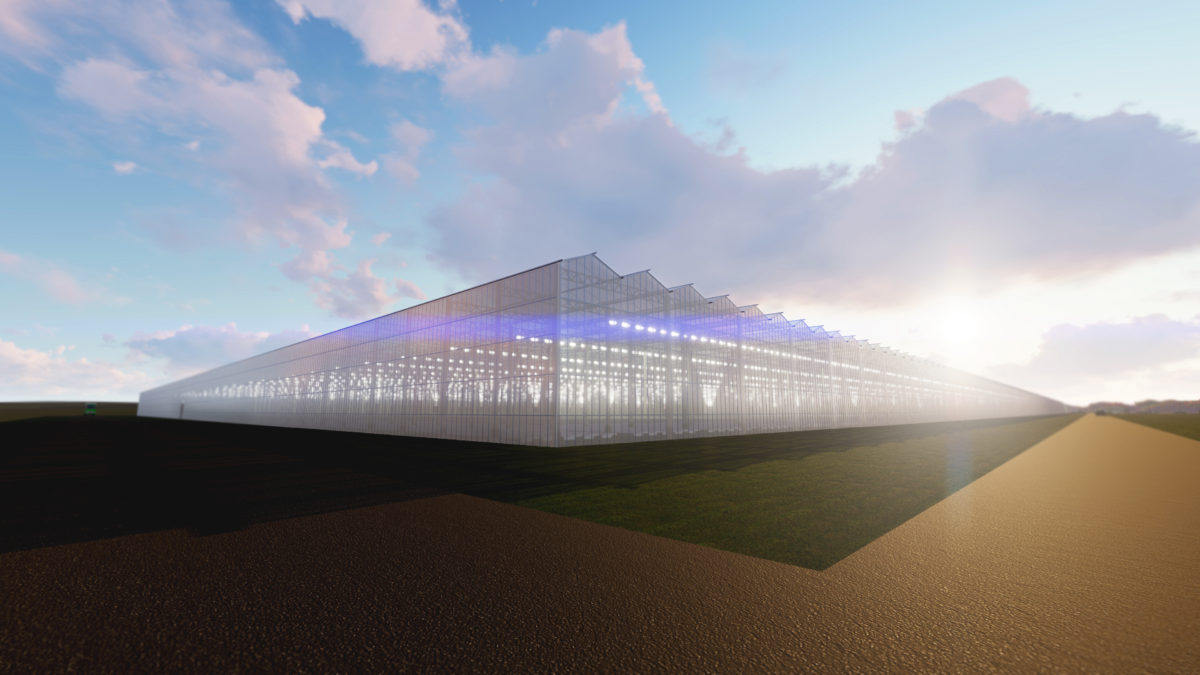

The $82 million all-cash deal is being conducted through Equilibrium’s Controlled Environment Foods Fund, and will see to the construction of a 60-acre greenhouse that will be the company’s first of its kind agricultural facility in Appalachia.

“We’re building a Farming Now movement using proven technology to grow more fresh food with far less resources,” said Jonathan Webb, founder and CEO, AppHarvest. “Eastern Kentucky is mobilizing to lead the real food revolution and become the AgTech capital of America.”

Once completed and operational in 2020, the facility will produce non-GMO and pesticide-free tomatoes and cucumbers using 90 percent less water than traditional agriculture through the use of a 10-acre retention pond and circular irrigation system. And, being located within a one-day drive of 70 percent of the U.S. population, AppHarvest plans to distribute its produce to the top 25 grocers in the country through its partner, Mastronardi Produce.

“The 60-acre, state-of the-art facility will be one of the most sustainable, efficient and technologically advanced greenhouses of its kind,” said Paul Mastronardi, president and CEO and the fourth-generation family member to lead Mastronardi Produce, which will distribute the produce to America’s top grocers. “This is a significant milestone for Kentucky’s farming and food sectors.”

Dynamic Days

There’s been huge developments for Equilibrium Capital so far this year. In February, it was announced that Australia’s LGIAsuper is capitalizing upon consumer demand for high quality fresh food, and has committed $112 million to Equilibrium Capital’s newest fund – a vehicle focused on investment opportunities in fresh food production in North America.

“Australians who have visited the United States often comment that the fresh produce doesn’t taste as fresh as it does at home,” she said. “Fruit and vegetables in the U.S. have traditionally been imported from as far away as Mexico or shipped long distances across the U.S., which reduces freshness and impacts taste.”

As an investor, Equilibrium views greenhouse production as a category that is not only poised to answer these shifts in taste, but one that is also poised for private equity.

“We see a tremendous opportunity for the future of controlled environment foods,” said Equilibrium Chairman David Chen, who recently delivered a presentation on Institutional Scale Controlled Environment Agriculture at Global AgInvesting 2019 in New York this April.

That same month, Equilibrium Capital Group announced a partnership via equity investment in Houweling’s Group, an advanced greenhouse grower of tomatoes, bell peppers, and cucumbers. Together, Equilibrium and Houweling’s will modernize and expand Houweling’s advanced technology greenhouse facilities located in California and Utah.

“Farming is undergoing a profound shift to a capital and production infrastructure intensive model to meet the demands of consumers, retailers and food processors for more reliable, year-round, fresher, and sustainable foods,” said Chen at the time. “By partnering with top tier operators such as Houweling’s, we will grow with the demand for year-round greenhouse and regionally grown foods.”

The investment in Houweling’s follows closely upon Equilibrium’s $11.3 million investment in the Minnesota-based greenhouse operations of Revol Greens in December 2018.

Combined, the investments made by Equilibrium in these large-scale greenhouse operations across California, Utah, and Minnesota exceed $100 million, according to Impact Alpha, and will support Houweling’s and Revol in doubling the size of their operations over the coming two years.

Appalachia

The year-round food production and economic boost that these projects will bring to California, Utah, and Minnesota, will also benefit the Appalachian region of the U.S.

The non-profit group Feeding America estimates that 12.9 percent of Americans, including 17.5 percent of American children face food insecurity and often lack access to nutritionally adequate foods.

Furthermore, 25 percent of the people living in Appalachia are living in poverty. Appalachia’s dominant industry, the coal industry, has fallen from favor with employment falling to its lowest point since 1988, with 50,000 miners losing their jobs. In Morehead, where the AppHarvest greenhouse is to be built, 23.7 percent of the population lives in poverty, compared to a national average of 12.3 percent. This project will not only provide fresh produce, but will bring back 285 full-time permanent jobs, as well as 100 construction jobs to the region.

“AppHarvest is among the breakout ideas that is needed today. It envisions a fundamental change in how America farms,” said Jerrfey W. Ubben, founder and CEO of ValueAct Capital. “Its goal to establish Appalachia as a hub for AgTech technology and expertise also has far-reaching positive implications for jobs and education in the region and beyond. We look forward to working with the company as it pursues these exciting environmental and social goals.”

-Lynda Kiernan

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.