October 18, 2019

This article will be featured along with other articles addressing agriculture investment opportunities and surrounding themes in the GAI Gazette, Volume 6, Issue 4, which will be distributed in conjunction with the annual Global AgInvesting Europe event, to be held in London on 9-10 December 2019.

Join us in London to hear valuable insight and best practices from the expert speaking faculty, which includes the author below, Dr. David Hughes, Emeritus Professor of Food Marketing, Imperial College London, who will present “Consumer-Driven Megatrends and Their Implications on Agricultural Investment” on the first day of the event. Learn more and register.

By Dr. David Hughes & Miguel Flavián

Watch out, food industry pundits are about holding forth on key trends affecting your business in 2019. Blink and 2019 is gone and we’re into a new decade. So here, we focus on what the global and local food industry scene might look like in 2030 – it’s closer than you think!

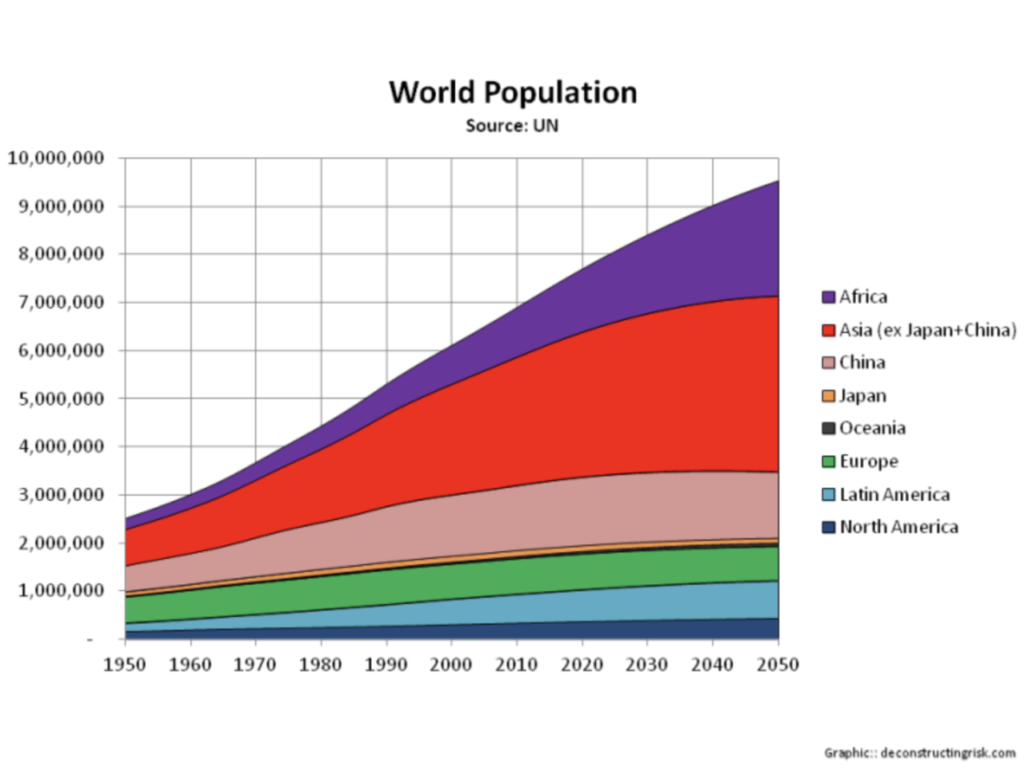

Good news to start with – the global population will have grown from 7.7 billion now to 8.5 billion by 2030; 800 million extra mouths to feed is both a challenge and a huge opportunity. Half of the population increase will come from Africa, and most will stay there if economic growth advances at a decent clip. However, if the African continent slips into the economic doldrums with slow growth and economic gains garnered only by a favored few, then, unhappy citizens will walk and most will head North, which could create a real immigration crisis in Europe! Much of the other half of the global population increase will be in Asia, not least the Indian sub-continent and Indonesia. Rapidly growing Asian countries are experiencing transformed diets benefitting particularly chicken, egg, fish, and dairy businesses, as well as soy producers (largely in South America and the U.S.). Intensive insect producers will be well-established by 2030, competing with soy to supplement accelerated livestock feed supply.

A Vision of the UK

What about the UK? We’ll add three million to our population over the next 10 years or so (from 67 million to 70 million) and that’s way better than in Japan, Russia, and Germany where numbers will decrease. Like many countries, the UK is aging fast – in 2018, 18 percent of us were 65 or older, and by 2030 it will be 28 percent. So what? Older folk eat less and, increasingly, are concerned about their health. If you’re over 60, stand on a chair and look out. What you can see is THE END and you’re bound and determined to push THE END out a bit further by improving your diet! In 10 years, most of us, irrespective of age, will be significantly more conscious of what we eat and its impact on our health. We’ll have a much better notion of our food goals, for example:

– if we aspire to be fit, toned, with an active lifestyle, then, food that is good for muscle-building, improving performance, and providing quick energy will appeal;

– or if wishing to retain (even improve) our looks, then, food and drinks that are good for the skin, assist weight control, and are anti-aging will be sought;

– or, maybe, we wish to be more zen, less stressed, with improved sleep quality and more balance in our lives, then a better digestive health diet might fit the bill;

– and for those with specific health problems, foods with known disease prevention/repair attributes, heart healthy, and allergen-free qualities might appeal.

By 2030, we’ll embrace technology much more than at present to assist us in food and drink selection. It’s happening right now – e.g. Professor Toumazou from Imperial College London has developed a cool DNA Nudge “machine/App” whereby you swab saliva from your mouth, pop it into his magic machine and, then, when shopping, zap the ingredient list of the food product you fancy and the DNA Nudge will advise you whether it is a good or bad purchase given your dietary proclivities.

In many countries, not least the UK, health systems will be under huge pressure because of the aging population, and two major diseases – heart health and Type 2 diabetes. Governments will have long moved on from simply recommending that we should moderate our diets and, as they are doing now for sugar, will wade in with hefty taxes on food and drink products high in sugar, salt, fat, and alcohol. Cannabis and hemp food and drink products will be closely regulated but pervasive for social and medical usage.

Incidentally, in early January 2019, world stock markets were reverberating because of concerns about slowing economic growth in China. Well, pardon the pun, here’s another Sino-wrinkle, by 2030 China’s population profile will be very similar to that of Japan’s in 2018, i.e. more old folks than young ones as a result of decades of the one child policy in China (now rescinded). In fact, China will get old before it gets “Western” rich and will have all the consequential labor, social, and health problems associated with such. AI and robotics may ease the pain of labor shortages and care of the elderly, but the years of China driving global economic growth are numbered.

Returning to the UK and other developed (as we amusingly call them) countries, consumer stress levels are on the rise and will continue to do so. Current millennials will be 10 years older and well into (for some) their child-rearing years. They’ll be increasingly peevish to have missed the spectacular financial gains made by Baby Boomers and Generation Xers from house price inflation. For the food industry, escalating consumer stress will simply accelerate the already well-developed trend towards providing snack and meal solutions and not problems. Whilst income distribution in the UK is unequal, perhaps surprisingly, it has not deteriorated significantly over the past decade. Notwithstanding this, consumer households in the bottom two income deciles are struggling now and will continue to do so over the next decade (irrespective of the political party(ies) in power). This will be exacerbated by the sharp growth in AI and robotics, which will squeeze jobs at the lower income end of the labor market. This will ensure that traditional supermarkets will continue to have a very strong focus on price. The Tesco/Sainsbury-Asda’s of our grocery retail world have broad shopper churches and can’t afford to lose the custom of their keenest price-conscious shoppers.

Green Bar Rising

The “green” packaging material is an important attribute of the overall product.

We’ve been talking for a few years about how “the green bar is rising” in the food industry. Globally, consumers are seeking products that are tasty, convenient, affordable, and that are good for their families’ health and for the health of the environment, local economy, food producers and their animals, etc. By 2030, putting consumers and society first will be pervasive in the world of business and such will be the transparency of supply chains and global communicative powers of social media, that “greenwashing” will be doomed to failure. Specific examples of how this will affect the food industry include:

– the burgeoning popularity of “climate-friendly” diets;

– an accelerated move to less, recyclable/compostable packaging (“Big Food” is promising this by 2025 – they won’t have that much time!);

– an increasingly global focus on reducing food waste – in richer countries, in the home and emerging countries on the farm, and in the supply chain;

The food sector under the most “green” pressure will be meat. By 2030, inexorable pressure relating to the impact of high levels of meat consumption on human health, the environment, and animal welfare will reduce the centrality of meat in Western diets exacerbated by the continuing growth of alternative protein foods (including “lab-grown” meat). A proportion of Generation Zers will hold the view that dispatching sentient animals for us to eat as being barbaric. Beef, lamb, and pork will be on the front line. Bye bye carnivores? Of course not, but flexitarian diets will be widespread. Our meals will look more Asian just as theirs look more Western (i.e. with more meat)!

Will Discounters Rule the Food Retail Scene?

This leads us on to thoughts on what the food retail scene might look like in 2030:

– Hard discounters (Aldi, Lidl, etc.) will continue to threaten the traditional supermarket players in every country where they are established. They’ll keep growing in the UK and hit 20 percent grocery market share in the next decade; likely, Aldi alone will take a 20 percent share Down Under giving long-term migraines to Woolworth and Coles (and, surely, Costco will add to the Australian Big 2’s tribulations by significantly increasing store numbers). Additionally, we shall see if the combined clout of Aldi, Lidl and the dollar stores become more a serious competitor than an irritant for Walmart, Kroger and Ahold Delhaize in the U.S. As an aside, we expect the much loved Trader Joe’s discount gourmet concept (Aldi North-owned) to appear outside the U.S. Will the German discounters seek to invade Asia and Africa? The combination of strong population growth and households with relatively low but increasing incomes would seem to be lip-smackingly attractive for a discounter. But, experience shows in Asia that local/regional operators are adept at out-competing the global monoliths! In Africa, there’s a serious challenge for even the super-efficient Aldi to cope with poor infrastructure, although, courtesy of President Xi’s “Belt and Road” initiative, internal road communications are improving but this may encourage retailers from China to try their hand in sub-Saharan Africa.

– As discounters continue to expand in mature markets, the big three or four traditional supermarkets will look to hang on to their current share. In markets such as the U.S. with a distinct regional structure, expect to see smaller regional players disappear. In all markets throughout the upcoming decade, there will be a dog fight on price, more concentration, agreements between non-competing retailers to negotiate together (à la Tesco and Carrefour), sharing services, and grocery retailers looking to increase their customer base with linkages into independent stores and food service (à la Tesco’s takeover of Booker).

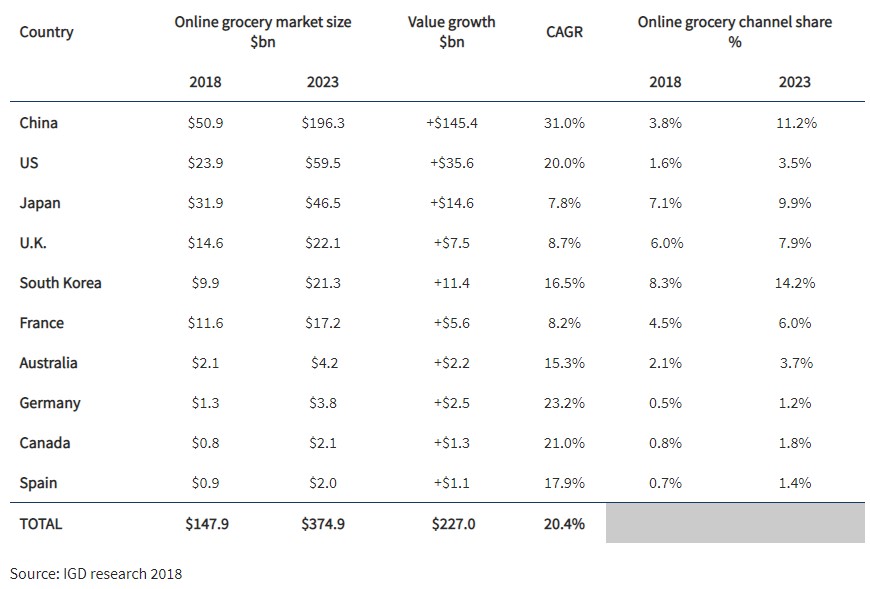

– On-line grocery sales will march on with a range of offers (click and collect, one-hour delivery, etc.) driven by millennials reaching the “nest-building” stage of their lifecycle – online will simply be the normal way to purchase food, unless it’s dashing out to a store for emergency purchases or, if they want to prepare a special meal and take the time to seek advice from a retail artisan. Amazon will struggle to compete in fresh and chilled prepared foods in the absence of a significant store base, which suggests Amazon will either exit fresh or purchase other grocers and push on relentlessly. Check out what Alibaba/Hema and JD/7Fresh are up to in China to find out what is going to happen here – for convenience retailing and retail theatre overall, we have much to learn from the Asian experts.

– Tesco and Walmart emerge as two of the world’s leading practitioners of omni-channel retailing, although the dynamic action in online is best observed in Asia, not least China and South Korea.

– Big stores will suffer through the decade and dwindle in numbers, but little stores and, in particular, mini-stores, will flourish, popping up like weeds in every apartment and office block, hospital, entertainment area, indeed, wherever people congregate. Some of them will not necessarily be manned as the system will recognize us when we enter, and cameras will record anything we purchase in the store. The offer? – fast turnover, healthy, tasty snacks, mini-meals and regular meals (again, see best practice of this in Asia with the likes of 7-11 stores).

– Increasingly, special interest groups and activist shareholders are influencing the policies and activities of major companies (e.g. on executive/gender pay, the environment). Major retailers will have to become accustomed to such pressure, particularly in relation to product sourcing – consumers will ask “remind me again, what foods can’t I eat?”, whether it be slave-tainted shrimp from Thailand, orangutan-harming palm oil from Malaysia, chicken that has been fed on soy from the Amazon Basin, wrappers that are not recyclable, etc.

– The next 10 years will see a technological revolution in our supply chains it’s already well underway with robotic picking, blockchain and its equivalents becoming mandatory, Big Data and individual loyalty data personalizing offers, and grocery shopping experience being transformed – “drudge” shopping for routine essentials disappearing as IoT kicks in and the loo paper inventory is managed by our lavatorial product provider in the clouds, while we can elect to shop for “touchy feely smelly” stuff in a store with knowledgeable staff or online talking directly to the producer. Mind you, there’s a dark side to the IoT/AI/Robotics era which is rushing towards us. Indubitably, criminal hackers will see opportunities to hold us and our food supply chains to ransom and this will elevate concerns about food security to a higher and darker level.

– Climate change will have an important impact, not least on fresh produce. Weather extremes can create havoc with supply programs. In Europe, we’ve seen this with The Beast from the East disrupting arable crops, winter deluges in Spain destroying salad crops, and droughts in summer across the continent sharply reducing produce yield and quality. Expect to see serious growth in urban hydroponic farming and continued expansion of protective cropping (e.g. polytunnels). Seasonal eating may well have a renaissance as consumers match their fine words and thoughts on being greener with their actual food purchasing and consumption behavior.

– We’re already seeing the accelerated convergence of food retailing and food service and this will continue apace. Note in the UK that, for food-to-go, traditional supermarkets are upping their game but are still only in third place to specialty operators (such as Pret and EAT) and the fast food operators that will be attempting to get a slice of the food for home market! The food-to-go market will flourish in the big and most visited cities, and we think London will be a global leading light in innovative, freshly-prepared meal and snack solutions, reflecting its cosmopolitan population and their voracious appetite to try anything new.

– From a fresh food sector perspective, suppliers will benefit substantially over the coming decade as the importance of emerging routes to the consumer increase, in addition to the traditional supermarkets and hard discounters. Understanding and being in concert with the values and aspirations of consumers will be vital. “Greener” consumers will be hard taskmistresses – local food with trusted provenance will continue to flourish and look towards towns and cities seeking to become carbon neutral, even self-sufficient in their energy use.

The global food industry is changing and fast and the pace seems to be accelerating. Consumer trends permeate the globe at an astonishing rate, with social media the lubricant. “Big Food” companies (including retailers), when pondering food industry evolution, would do well to recall a couple of Charles Darwin quotes, viz.: “It is not the strongest of the species that survives, nor the most intelligent …. It is the one that is most adaptable to change.”; and “In the long history of mankind … those who learned to collaborate and improvise most effectively have prevailed.”!

NOTE: This article, which has been modified with authors’ permission, first appeared in the blog “Supermarkets in Your Pocket” on January 7, 2019 at: https://supermarketsinyourpocket.com/2019/01/07/food-industry-trends-2019-will-go-in-a-flash-so-whats-the-picture-look-like-in-2030/.

About the Authors

David Hughes is Emeritus Professor of Food Marketing at Imperial College London. He travels the world talking to businesses, trade associations, governments, and conferences on global developments in the food and drink industry. A highly sought-after speaker wherever he goes, he has an unparalleled knowledge of global food issues and opportunities.

David Hughes is Emeritus Professor of Food Marketing at Imperial College London. He travels the world talking to businesses, trade associations, governments, and conferences on global developments in the food and drink industry. A highly sought-after speaker wherever he goes, he has an unparalleled knowledge of global food issues and opportunities.

Miguel Flavián is a food professional who works as an international advisor to food companies, with a particular focus on those that want to learn from the UK grocery market.

Miguel Flavián is a food professional who works as an international advisor to food companies, with a particular focus on those that want to learn from the UK grocery market.

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.