November 29, 2021

By Paul McMahon, Managing Partner, SLM Partners

Paul McMahon will be a featured speaker at GAI Europe, 6-7 December, London UK. Click here to learn more and register.

Introduction

Spain and Portugal have emerged as a new destination for investors seeking to deploy capital into orchard crops such as tree nuts and olives. A number of deals have recently been completed, and groups are raising funds to invest in this area. SLM Partners has been working in this region for more than two years. We are now raising a diversified European forestry and permanent crop fund that will allocate capital to these countries, with a special focus on regenerative and organic systems. This article explains the reasons why Iberia is attractive to investors, the specific opportunities around tree nuts and olives, and the need to invest in ecological management approaches that will deliver environmental benefits as well as financial return.

Why Iberia?

There are a number of reasons why Spain and Portugal compare favourably with other regions for investment in permanent crops.

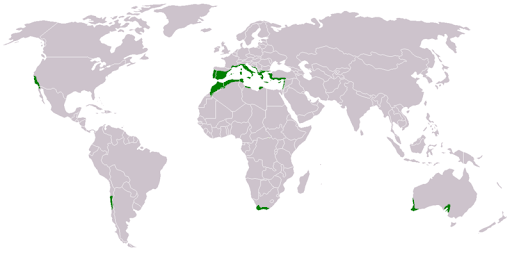

First, they have the right climate (mild, wet winters and hot, dry summers) to grow nutritious, high-value Mediterranean orchard crops. These crops include olives, citrus, stone fruit, grapes, and a range of tree nuts (almonds, pistachios, walnuts, hazelnuts, chestnuts, and pine seeds). There is a small area globally in which these crops can be grown and an even smaller area within developed economies.

Second, although there are parts of Iberia that suffer from water stress, there are areas with good access to reliable irrigation water. For example, the recent completion of the Alqueva dam and reservoir, the largest artificial lake in Europe, brought irrigation to 120,000 hectares in the Alentejo region of Portugal.(1) Spain and Portugal also benefit from higher rainfall than similar production regions in California, Australia, or North Africa, which makes non-irrigated (rainfed) production possible.

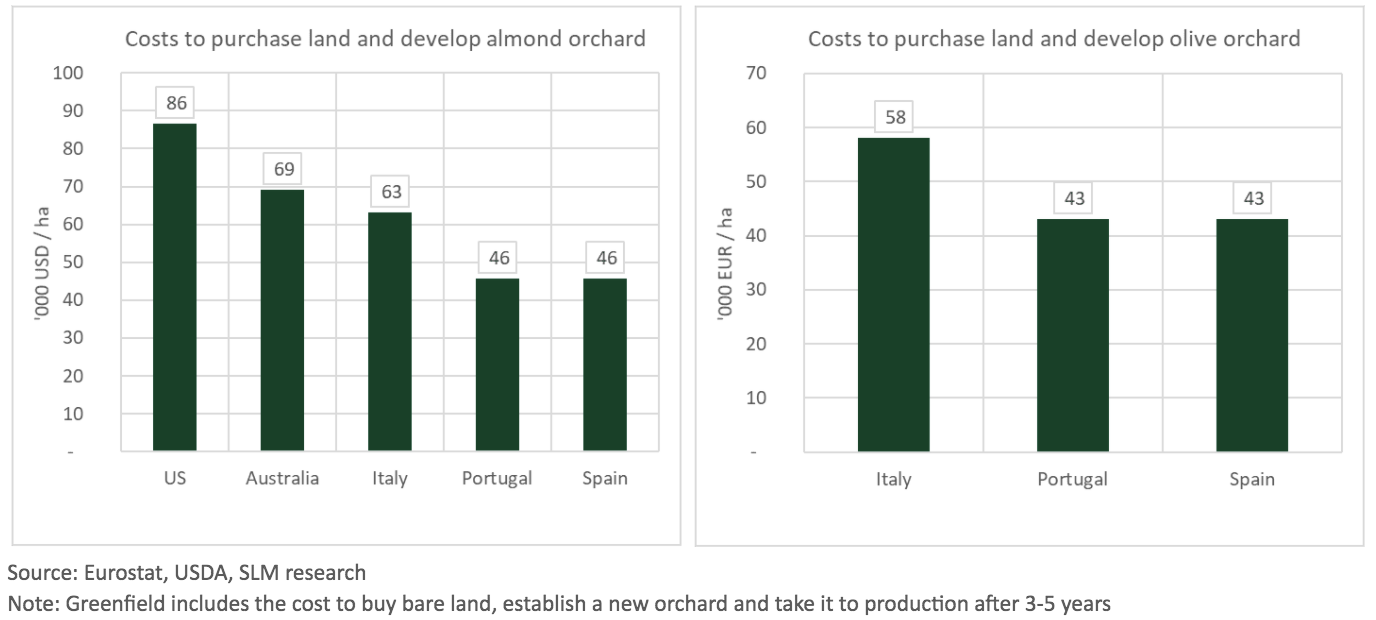

Third, the region has competitive production economics. Agricultural properties in Spain and Portugal tend to be larger than the European average, which allows for economies of scale. Iberia has lower land values than other well-established permanent crop regions such as the U.S., Australia, and Italy (although land prices are now rising). Operating costs, especially labour costs, are also lower.

Source: Eurostat, USDA, SLM research

Note: Greenfield includes the cost to buy bare land, establish a new orchard and take it to production after 3-5 years

Finally, Spain and Portugal have good access to the largest and most lucrative food market in the world – western Europe. Aside from having tariff-free access to all European Union (EU) countries and the UK, both countries benefit from excellent logistical infrastructure and are fully integrated into the value chains of major European food companies and buyers. Businesses also benefit from a strong rule of law and a stable currency (the Euro).

Tree nuts

Driven by dietary trends, the value of the global tree nut market has grown at 7 percent per annum since the 2011/12 season to reach $38.8 billion in 2020/21.(2) Almonds, pistachios, and walnuts account for 63 percent of this market. The U.S. is the dominant player on world markets, responsible for 90 percent of all global almond exports and around 50 percent of walnut and pistachio exports.

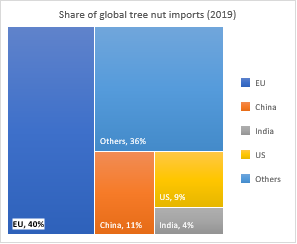

The EU is by far the biggest importer of tree nuts in the world, taking 40 percent of global tree nut imports on a weight basis in 2019. There is a growing supply and demand gap for most tree nuts in the region as European consumers seek out healthy, nutritious foods. The EU consumes around three times more almonds and walnuts than it produces and 7.5 times more pistachios.(3) Altogether, the value of EU imports of almonds, walnuts, pistachios, and hazelnuts was around $6.5 billion in 2019.(4)

Source: International Nut and Dried Fruit Council (INC)

Spain and Portugal are well-positioned to increase their production of tree nuts and to supply the European market. Both countries have a long tradition of rainfed almond orchards, but there has been a concerted effort to increase the area of high-yielding, irrigated orchards over the last 10 years. This new trend is most evident in the Alqueva irrigation district in Portugal. Between 2015 and 2020, the area planted with almonds increased 15-fold to over 15,000 hectares. (5)

Olives

Although Europe is a minor producer of tree nuts in global terms, and a big net importer, the situation is the opposite for olives and olive oil. The EU is the powerhouse of the global olive oil market. Spain is by far the largest producing country accounting for around 45 percent of global output. Portugal produces 3.5 percent of the world’s olive oil but this figure is growing rapidly.(6) In recent years, there has been a shift in production from the eastern to the western Mediterranean, away from Italy and Greece towards Spain and Portugal.

Olive oil is a high-value product with a unique flavour and nutritional profile. It sells for at least three times the price of other vegetable oils. The market has grown at around 3 percent per year since 1990, mainly driven by increased demand in northern European countries, the U.S., Japan, Brazil, and China, due to the greater popularity of Mediterranean diets. There is considerable room for growth in per capita consumption in those countries.

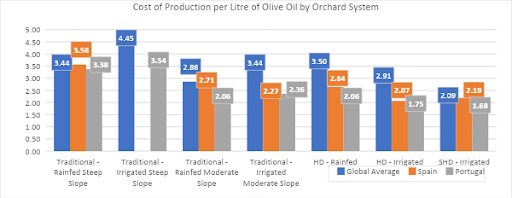

Spain and Portugal will continue to grow their production to serve these high-value markets. We also see an ongoing shift towards more intensive, mechanised orchard systems. There are large areas of traditional, low-yielding orchards in both countries that rely heavily on manual labour for pruning and harvesting. It is increasingly hard to find people to do this work. In recent years, new high-density orchards have been developed that make use of overhead harvesting machines and other labour-saving methods. Olive production will increasingly shift to these systems, and investment capital will be needed to support this transition.

Source: International Olive Council

The need for regenerative management

However, intensification is not an end in itself and it can lead to negative environmental impacts. Intensive orchards make heavy use of external inputs such as synthetic fertilisers and pesticides, which can cause soil degradation, water pollution, biodiversity loss, and high Greenhouse Gas (GHG) emissions. The health of farm workers is also damaged by exposure to toxic agrochemicals.

Traditional rainfed systems in Mediterranean zones also suffer from land degradation. Soils are often kept bare through tillage or application of herbicides, which can lead to soil erosion, nutrient run-off, and loss of soil organic matter.

In recent years, innovative farmers have developed regenerative practices that build soil health, reduce reliance on external inputs, and have a positive impact on biodiversity, water, and carbon cycles. Broadly defined, the key principles of regenerative agriculture are minimizing soil disturbance, eliminating or reducing agrochemical use, keeping soil covered, maximizing plant diversity, and integrating livestock. Although the regenerative agriculture movement is more developed within annual cropping and livestock systems, the same principles can be applied to permanent crops.

We are working with a number of growers using regenerative practices in orchards in Iberia and other parts of the world. Key practices include planting cover crops between tree rows, minimizing tillage, using composts and biological fertilisers, and planting hedgerows or pollinator habitats for integrated pest management. These systems can produce nuts, olives, and other crops in a profitable way while storing carbon and improving soil health.(7) By increasing soil organic matter, they also use water more efficiently.

Organic opportunities

Regenerative orchard management is often the first step in the transition to a fully organic system. There are major opportunities for organic certified tree nuts and olives in Iberia, so long as operators have the required technical knowledge.

Demand for organic food is growing at a rapid pace. The value of organic retail sales reached €106.4 billion globally in 2019, having grown at an annualised rate of 11 percent since 2000. The U.S. and Europe are the two largest markets,worth close to €45 billion each in 2019. There is a shortage of organic certified nuts, leading to high price premiums. For almonds, this premium is around 100 percent and for other nuts it ranges from 30 percent to 70 percent. There is also a stable price premium for organic olive oil, averaging 23 percent over the last 10 years.(8)

Under its Green Deal and Farm-to-Fork strategies, the EU has set a goal of converting 25 percent of agricultural land to organic certification by 2030. The current figure is around 8 percent. This is much higher than other regions: for example, the proportion of agricultural land in the U.S. under organic certification is just 0.6 percent.(9)

Iberia has the potential to carve out a position as a dominant producer of organic tree nuts, olives, and other orchard crops. Indeed, this is already the case for almonds: in a reverse of conventional trade flows, the U.S.is a net importer of organic almonds and most of these are sourced from Spain. Consumer trends, public subsidies, new research, and farmer culture will continue to support the growth of organic farming in the EU, including for orchard crops.

Investment approach

SLM Partners is developing a new impact fund, the SLM Silva Europe Fund, that will invest in forestry, orchard crops, and agroforestry in the EU. The new fund will have a substantial allocation to tree nuts and olives in Spain and Portugal, and will invest in regenerative and organic production systems, both greenfield and brownfield. We are forging relationships with local operators who specialise in these ecological management practices and who want to expand. Local knowledge and strong operator alignment are critical for all agricultural investments – they are especially important in this region. Our goal is to develop a ‘Climate Positive’ fund that will store more carbon than it emits, while having measurable beneficial impacts on biodiversity and soil health.

###

About The Author

Paul McMahon is a co-founder and managing partner of SLM Partners, an asset management firm that uses investment capital to scale up regenerative farming and forestry systems. The firm has $200 million in assets under management and invests in organic farming, pasture-raised beef, and sustainable forestry in the U.S., Australia, and Europe. McMahon is now leading the development of a new fund that will invest in ‘Climate Positive’ forestry and permanent food crops in multiple EU countries. He has published a book and multiple papers on the global food system and holds a PhD from Cambridge University.

Citations:

- Empresa de Desenvolvimento e Infra-estruturas do Alqueva (EDIA)

- International Nut and Dried Fruit Council (INC)

- USDA

- FAO

- EDIA

- International Olive Council

- Fenster, T., LaCanne, C. E., Pecenka, J. R., Schmid, R. B., Bredeson, M. M., Busenitz, K. M., Michels, A. M., Welch, K. D., & Lundgren, J. G. (2021). Defining and validating regenerative farm systems using a composite of ranked agricultural practices. Soto, R. L., Martinez-Mena, M., Padilla, M. C., and de Vente, J. (2021). Restoring soil quality of woody agroecosystems in Mediterranean drylands through regenerative agriculture. Agric. Ecosyst. Environ. 306:107191. doi: 10.1016/j.agee.2020.10719

- POOLRed

- FiBL & IFOAM, The world of organic agriculture 2021

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.