April 27, 2023

By Lynda Kiernan-Stone, Global AgInvesting Media

Headquartered in Ft. Worth, Texas, Harvest Returns was founded in 2016 by two military veterans to democratize the ag investment process by connecting individual ag investors with producers in need of capital looking for an alternative to traditional bank loans.

Understanding that ag investment has long been a compelling asset class that has traditionally been inaccessible to individual investors, the firm has quickly become a disruptor by providing growers a streamlined, flexible source of capital, and offering qualified financiers and agribusiness entrepreneurs a curated, diversified portfolio of farms, ranches, and timberland investment opportunities starting at a $5,000 minimum commitment.

Chris Rawley, CEO of Harvest Returns, explained in 2017, “By combining the benefits of agriculture with the ease of our investment platform, we are providing access to a larger pool of investors to farmland, ranchland and timberland ownership. Plus, we are bringing them closer to the hard working farmers who grow their food.”

In June 2020, the platform announced it had achieved the benchmark of $5 million in agricultural investments, having built by that point, a community of 5,000 investors and approximately 700 farmers, reachers, and agribusinesses.

Now, not even three years later, Harvest Returns announced it has reached the milestone of raising $30 million across 50 farming, ranching, and agribusiness investment opportunities. Its community has also more than doubled, growing to more than 13,000 investors and more than 1,500 farmers and agribusinesses.

“With the banking crisis and farm lending contracting, agribusinesses need flexible, creative financing, now more than ever,” said Rawley. “Our private credit deals solve that problem for farmers and ranchers, while at the same time providing high yield, secured income for our investors.”

Since 2017, Harvest Returns has offered private credit investments in sustainable livestock production, a segment that the firm stated has remanded some of its most popular vehicles, being collateralized with real assets including land, farm equipment, and livestock inventories.

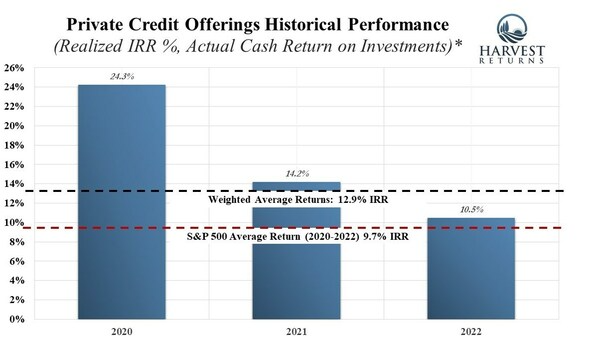

From 2020-2022, the weighted average returns of the company’s private credit livestock offerings were 12.9 percent – exceeding the average returns posted by the S&P 500 Stock Index.

To-date, the firm has distributed $7.1 million to investors, reflective of the successful democratization of agricultural investing and the ability of individual investors to capitalize upon the same benefits that agriculture offers to institutional investors: diversification, appreciation of land values, marginal correlation to the overall stock market, lower risk of loss during market corrections, and a hedge against inflation.

The firm also offers its Sustainable Agriculture Opportunity Zone Fund, established to invest and create positive impact in the ag industry across disadvantaged regions of the U.S. by operating under its mission “to achieve tax-advantaged capital appreciation in production agriculture projects that are economically, socially, and environmentally sustainable”.

~ Lynda Kiernan-Stone is editor in chief with GAI Media, and is managing editor and daily contributor for Global AgInvesting’s AgInvesting Weekly News and Agtech Intel News, as well as HighQuest Group’s Unconventional Ag. She can be reached at lkiernan-stone@globalaginvesting.com.

*The content put forth by Global AgInvesting News and its parent company HighQuest Partners is intended to be used and must be used for informational purposes only. All information or other material herein is not to be construed as legal, tax, investment, financial, or other advice. Global AgInvesting and HighQuest Partners are not a fiduciary in any manner, and the reader assumes the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on this site.

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.