By Stephen Johnston, Director, Veripath Partners

Based on what can only be described as the massive growth of the global money supply in the last 12 months, the apparent willingness of central bankers to continue to backstop unprecedented fiscal deficits, and a large contraction in economic activity, it appears we have the raw materials for a period of high inflation, if not outright stagflation. Central bankers have been explicitly monetizing government funding shortfalls during the pandemic, something that was considered strictly taboo a few short years ago (even though it can easily be argued that this has been the indirect and intended effect of central bank activities for decades).

Therefore, we believe a good corollary for current market conditions may be the 1970s. The term that defined that era was “stagflation”. Stagflation risks have once again become a consideration for investors. Stagflation is that unfortunate set of circumstances in which economic growth slows while prices rise (in the 1970s it was caused by the OPEC oil price shock combined with loose monetary and fiscal policy in the U.S.). Examining the 1970s more closely, we see that there was a bout of stagflation during the second recession of that decade. Inflation reached levels over 12 percent in 1974 combined with 8 percent unemployment. This created an economic malaise that was difficult to escape for years. It may seem counterintuitive to have high inflation and low growth, but it can happen. It also is a very difficult environment in which to generate real returns.

The response to the economic contraction caused by COVID has been large fiscal deficits coupled with correspondingly large increases in the global money supply. Just the U.S. Federal Reserve’s balance sheet alone has doubled, with the ECB, BOC, BOE, and BOJ right alongside. Remember that the G7 nations are the world’s largest debtors, and given the asymmetrical distribution of the benefits (funding for governments) and the costs (inflation for taxpayers and bond holders), we should not discount that there may be an incentive to try to keep monetary conditions unchanged for longer than is expected. While Austrian economist Ludvig von Mises would suggest that such monetary behavior cannot persist indefinitely, let us not digress other than by leaving him with the last word on this point:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of the voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

Many will argue Mises is wrong. Time will tell. Fortunately, this does not alter the farmland investment premise. The case for farmland in inflationary and even more so, in stagflationary macro conditions is hard to discount. Farmland is well recognized to be a classic inflation/stagflation hedge. The reason for this behavior is, we believe, that:

Properly managed farmland is a unique non-depleting, commodity producing capital asset that is priced as producing an infinite series of commodities which are consumed, which have very low stock to flow, and whose demand curve is inelastic.

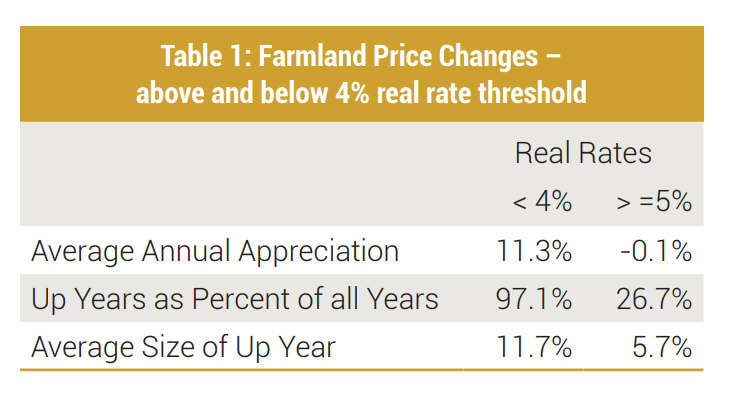

We conducted an analysis of the historical appreciation behavior of Canadian farmland in various inflation regimes to test the inflation/stagflation hedging assumption. However, rather than focus on the trend of the nominal data, we used a real rates lens – with a focus on average up-year appreciation rates versus risk of drawdowns. To perform this analysis, we divided the real rate environment as follows:

~ Lower-rate environments – real rates less than 4 percent

~ Higher-rate environments – real rates equal to or greater than 5 percent

Real rates were determined using 10-year CAD bonds minus CPI and land appreciation data was incorporated from 1970 to 2019 to include the 1970s stagflation event. By analyzing the series in this fashion, rather than simply conducting a correlation analysis over the time series, some interesting behaviors became apparent and are summarized in the table below:

Farmland’s appreciation behavior versus real rates was very asymmetrical. When real rates were less than 4 percent almost every year was an up-year, and the up-year average rate of appreciation was approximately 12 percent. Compared to when real rates were higher than 5 percent – only 25 percent of the years showed appreciation and the up-year average rate of appreciation was approximately 6 percent. The data from the table can be visualized as follows:

It seems safe to conclude that real rates had a material effect on the behavior of Canadian farmland over the 50-year period studied. To put this more concretely, Canadian farmland prices increased over 250 percent in real terms in the 1970s, outperforming the S&P, U.S. real estate and bonds.

If today’s monetary authorities are taken at face value, conditions should continue to be favorable for farmland. Central bankers are even signaling a desire to let inflation trend upwards while continuing to suppress the long end of the yield curve. If real rates were to go negative in this fashion, history shows this would be even more conducive to farmland appreciation.

ABOUT THE AUTHOR:

Stephen Johnston has over 25 years experience as a fund manager from the debt and private equity perspectives. As a senior fund manager at Société Générale Asset Management UK, Johnston oversaw the private equity portion of a series of closed-end funds investing across all sectors in the emerging markets of the former Soviet Union, Eastern Europe, the Baltics, and the Middle East. He has been involved in multiple funds investing into the Canadian alternative space with AUM approaching $1B in aggregate – including strategies deploying capital into farmland, private credit, energy, and SME PE. Johnston launched Canada’s first RRSP/TFSA eligible farmland investment vehicle and Veripath, one of Canada’s first open-ended farmland investment funds. He has a BSc. (1987) and a LLB from the University of Alberta (1990) and an MBA (1994) from the London Business School.

Veripath is a Canadian alternative investment firm. Veripath implements its farmland strategy in a way that seeks to preserve as far as possible farmland’s low-volatility return profile – the attribute that generates a material portion of Canadian farmland’s superior risk adjusted returns. Veripath does this by seeking to minimize operational, weather, geographic, and business-related risks – and capture the pure return from land appreciation. Veripath uses a unique split fund, evergreen structure which opens the Canadian farmland thesis to the largest possible universe of investors. Canadian farmland allocations have several compelling characteristics that make them a worthwhile portfolio allocation for both institutional and retail investors and Veripath’s structures are available to both. For further data on Veripath real rate, inflation and other research on farmland please go to: www.veripathfarmland.com/resources.

Disclaimer: Our reports, including this paper, express our opinions which have been based, in part, upon generally available public information and research as well as upon inferences and deductions made through our due diligence, research and analytical process. The information contained in this paper includes information from, or data derived from, public third-party sources including industry publications, reports and research papers. Although this third-party information and data is believed to be reliable, neither Veripath Partners nor it agents (collectively “Veripath”) have independently verified the accuracy, currency or completeness of any of the information and data contained in this paper which is derived from such third party sources and, therefore, there is no assurance or guarantee as to the accuracy or completeness of such included information and data. Veripath and its agents hereby disclaim any liability whatsoever in respect of any third-party information or data. While we have a good-faith belief in the accuracy of what we write, all such information is presented “as is,” without warranty of any kind, whether expressed or implied. The use made of the information and conclusions set forth in this paper is solely at the risk of the user of this information. This paper is intended only as general information presented for the convenience of the reader and should not in any way be construed as investment or other advice whatsoever. Veripath is not registered as an investment dealer or advisor in any jurisdiction and this report does not represent investment advice of any kind. The reader should seek the advice of relevant professionals (including a registered investment professional) before making any investment decisions.

The opinions and views expressed in this paper are subject to change or modification without notice, and Veripath does not undertake to update or supplement this or any other of its reports or papers as a result of a change in opinion stated herein or otherwise.

* All views, data, opinions and declarations expressed are solely those of the author(s) and not of Global AgInvesting, GAI News, or parent company HighQuest Group.