By Lynda Kiernan, Global AgInvesting Media

The first half of 2020 has been a marked investment period for ag and food tech investment, according to the mid-year findings from ongoing research being conducted by Finistere in partnership with PitchBook that examines global financing activity across both the agtech and foodtech sectors.

Although the greater part of the capital moved in Q2 in response to the global pandemic, total agtech investment for H1 2020 topped $2.2 billion, approaching the full-year record of $2.7 billion set for all of 2019.

Likewise, during the same time period, foodtech investment was ahead of the pace, exceeding $4.8 billion for the first half, compared to investments totaling $7 billion for the entire year prior.

Agtech financing overview:

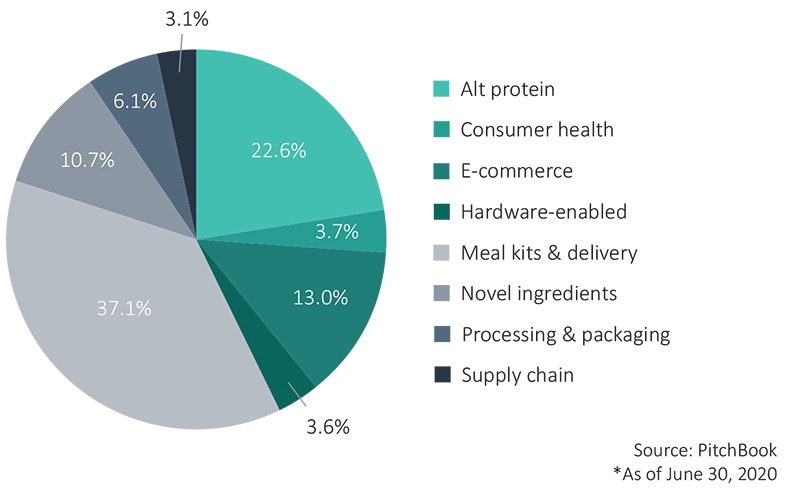

Foodtech financing overview:

Drilling down, the research determined that:

~ Investors are working to help startups push beyond COVID-19 to generate evidence of their intrinsic value and ability to scale, to position in a way to attract future growth investors.

~ Bridge funding and/or round extensions have been quickly deployed by syndicates with dry powder with intentions to push cash positive dates to the end of 2021 or beyond for their existing portfolio companies.

~ Rounds led by new investors have played a smaller role in capital activity for H1 2020 – a trend that will likely continue as managers assess market conditions.

~ However, as new investors gravitate toward the space, (particularly food tech) the trend toward growth in capital will continue.

“The venture investment consequence is likely to be that startups in this space are under a double imperative,” said Arama Kukutai, co-founder and partner, Finistere, “– to prove their return on investment to farmers and their agronomists that they are essential and will help drive better on-farm profit, while also showing they can scale to profitability.”

PitchBook mentioned, “It is unsurprising that new investor-led rounds have been a lesser part of the total, which is likely to continue while capital managers take stock of the market conditions–likewise, with some exceptions, we expect valuations will be under pressure looking forward. Valuations tend to be “sticky” so it will likely require a year or more for the true impact of COVID-19 to manifest in this metric. That said, we can see a clear delineation by stage impact.”

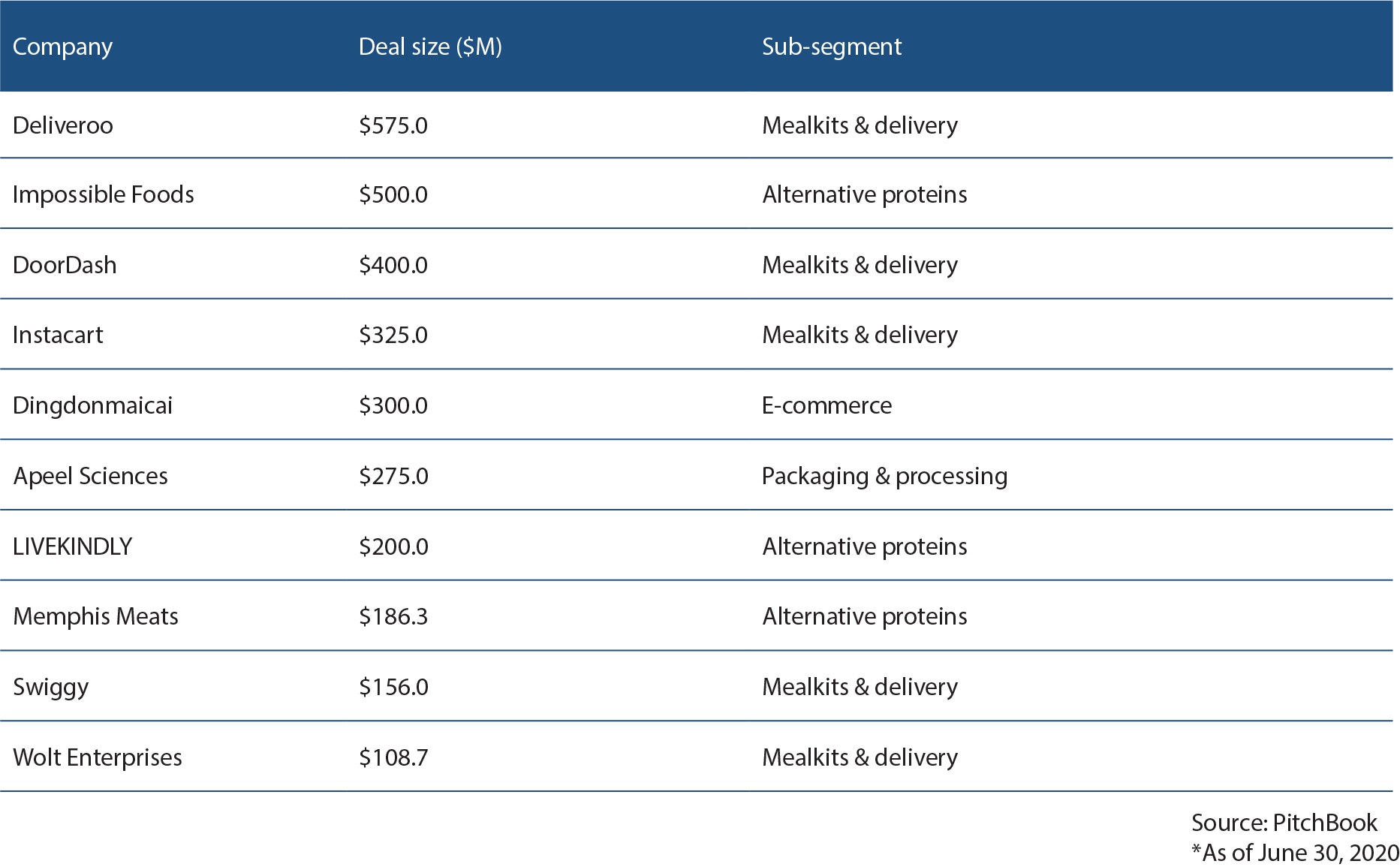

This impact manifested in pre-money valuations in early-stage investments across ag and food tech decreasing, however valuations for late-stage financings remained strong despite the pandemic, and mega-rounds valued at more than $100 million have continued, with every one of the top ten food tech deals, and half of the agtech deals being counted as such.

Top Ten Agtech Financing Rounds:

Top Ten Foodtech Financing Rounds:

Notable changes for the first half include:

~ Greater domination of the agtech industry by crop inputs and input management segments, which accounted for 60 percent of total agtech funding for the half.

~ Animal tech emerged as a key new category with 7 percent of total funding – a trend that is expected to continue.

~ Alternative proteins unseated e-commerce, rising to the second place holder for financing, behind meal kits and delivery, which continue to lead the food tech sector.

Kukutai noted that in the short term, Finistere expects continued consolidation in the agtech space to negatively impact investment and exits.

However, genuine breakthroughs such as the work being developed by startups such as Finistere portfolio companies Enko Chem and ZeaKal – that are building out pipelines of safe agrochemical alternatives, better compositions, and higher yields in row crops – will be rewarded, as global input giants like Bayer, Syngenta, and Corteva need new technologies to show farmers and the public markets continued innovation through consolidation.

“In contrast, the Foodtech sector, while challenged in foodservice, has some promising tailwinds,” said Kukutai. “It is our view that there will be lasting and persistent changes to consumer behavior in at-home consumption, and interesting to note this is the first year since 1994 that restaurant share of food consumption dropped versus in-home.”

Kukutai also gave a nod to the boom in alternative protein financing over the past three years, saying that the segment continues to garner mega-rounds such as those raised by Memphis Meats and Perfect Day, indicating strong investor appetite for the cellular ag and cultivated protein categories.

“Given the deep technical challenges underpinning these platforms and the capital intensity required to build operating facilities as well as marketing and channel investment for go-to market, this segment will likely need deep pocketed support and patient money to succeed,” said Kukutai.

Looking forward, Finistere and PitchBook forecast that agtech will face challenges through 2021.

“While the start of the year provided a massive infusion of capital, agtech companies are likely to face a turbulent outlook for 2021,” said Kukutai.

“With farming margins already under pressure prior to Covid, the availability, cost and health of labor, trade conflicts and consumer/voter pressure for sustainability gains all pose meaningful headwinds. The venture investment consequence is likely to be that startups in this space are under a double imperative – to prove their return on investment to farmers and their agronomists that they are essential and will help drive better on-farm profit, while also showing they can scale to profitability.”

– Lynda Kiernan is editor with GAI Media, and is managing editor and daily contributor for Global AgInvesting’s AgInvesting Weekly News and Agtech Intel News, and HighQuest Group’s Oilseed & Grain News. She is also a contributor to the GAI Gazette. She can be reached at lkiernan@globalaginvesting.com