By Lynda Kiernan-Stone, Global AgInvesting Media

Let’s face it, the relationships we have with our most beloved foods can be complex. Climate change, rising costs, ethics issues associated with production and processing, and health issues plague many of our go-to favorites like chocolate, for example. And in some cases, the challenges even put the future existence of these foods at risk.

The cocoa industry has been long-beset with challenging issues – economic, environmental, and social – including climate change, deforestation, child labor issues, and smallholder producers earning barely the price of a candy bar per day.

Chocolate is almost universally loved. In 2022, consumers spent EUR$180 billion (US$190.5 billion) on chocolate, and the market is estimated to be worth EUR290 billion US$307 billion by 2030.

But, there’s a rub, because it relies on cocoa farmers who are predominantly smallholders in developing countries to continue to produce at a rapid pace. As mentioned above, these farmers largely live below poverty levels, leading them to turn to children who labor for little or no compensation. The U.S. Department of Labor’s Bureau of International Labor Affairs estimates that 2 million children in Ghana and Ivory Coast are working in hazardous conditions in the country’s cocoa farms. In many cases, these children are taken from their families at young ages, forced to harvest cocoa for years without returning home – a practice that has only become more prevalent in countries like Ghana and Ivory Coast over the past 10 years, despite initiatives to stop it.

Furthermore, Theobroma cacao can only thrive in very specific conditions found within a 20-degree band on either side of the equator, and grown under monoculture conditions, leading to clear-cutting and complete deforestation for cocoa farms in very ecologically sensitive regions. This “slash-and-burn” approach in West African cultivation has resulted in production increasing four-fold since the 1960s, however, it’s been at the cost of 90 percent of the area’s original forests, with less than 4 percent of Ivory Coast remaining densely forested today.

However, despite being in its infancy, and lagging behind cultured meat in scale, market penetration, and adoption, cell-cultured chocolate is showing real promise as a solution to the damaging realities of current cocoa production, and is one of the most dynamic segments in the food tech space.

One startup driving this transition is UK-based WNWN Food Labs (formerly known as Atlantic Food Labs), which announced it has raised $5.6 million through a Series A led by PeakBridge – a core member of EIT Food that invests in innovative, scalable, climate and health-focused companies with protected technologies and a long-term potential for positive impact.

Joining PeakBridge were Geschwister Oetker Beteiligungen Group via its subsidiary Martin Braun-Gruppe, Mustard Seed Maze, PINC – the venture arm of family-owned food and beverage company Paulig, Investbridge AgriTech, and HackCapital.

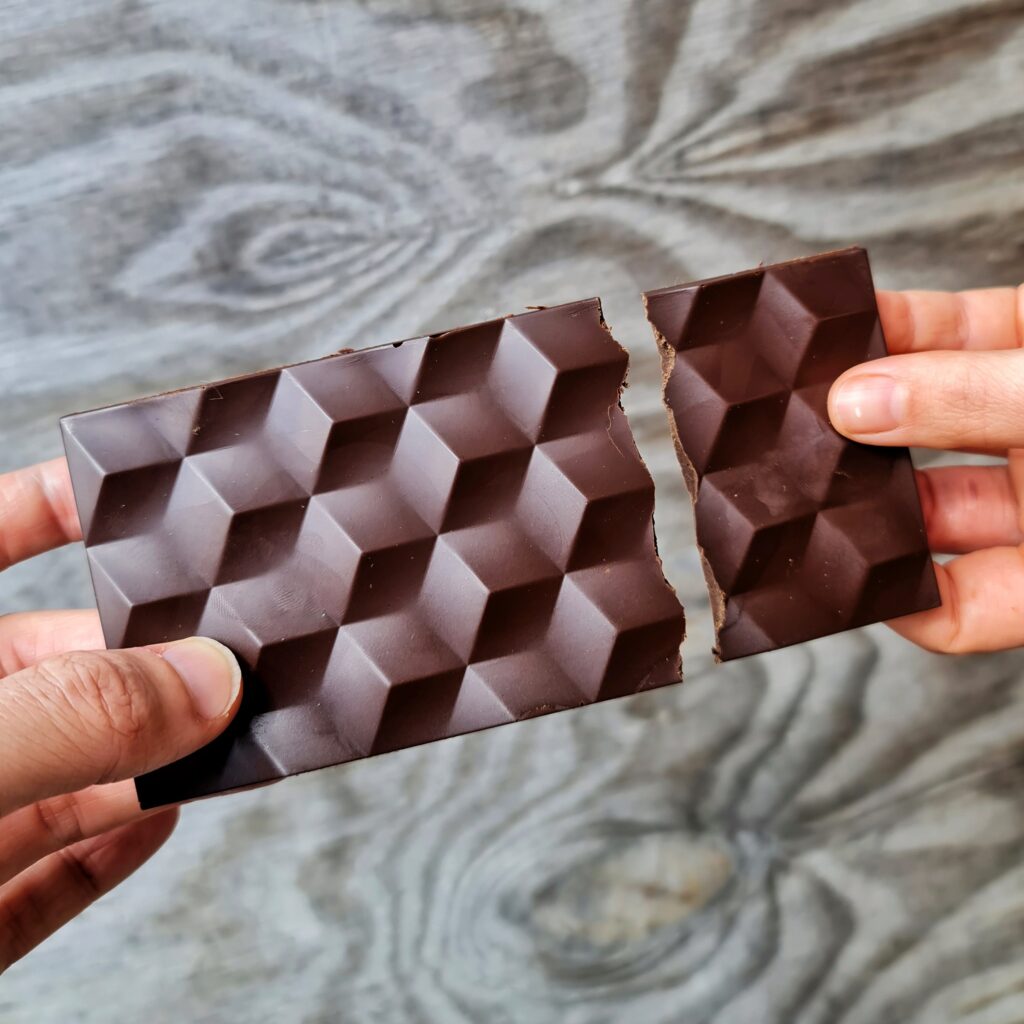

Using a proprietary fermentation process, WNWN transforms widely available plant-based ingredients like cereals and legumes into cocoa-free chocolate that is vegan, caffeine-free, gluten-free, palm oil-free, lower in sugar, and safe for dogs since it contains no theobromine. However, it does have the same taste, melting characteristics, snaps, and baking abilities as traditional chocolate, and produces 80 percent less carbon emissions than conventional chocolate, when based on an internal life cycle analysis, according to the company.

“We’re not anti-chocolate, far from it,” emphasized Dr. Johnny Drain, CTO, WNWN. “We’re against the strain the conventional cocoa supply chain places on the planet, and we aim to alleviate the pressures on the system by creating a viable and delicious alternative.”

“Ingredient innovations like WNWN’s are key to building a more resilient, equitable, sustainable food system, and this in turn opens the doors to other goals like responsible production and consumption,” said Erich Sieber, founding partner, PeakBridge.

“Not only does WNWN’s product have the potential to offer health benefits and address sustainability concerns, but it also opens up a world of exciting flavor possibilities. We are confident that WNWN will lead the charge in this category and are proud to be part of this journey.”

With this funding, WNWN stated it will scale up manufacturing and expand its team in preparation for a UK retail launch later this year.

The startup has already released two of its cocoa-free chocolate products: its Dark Choc Thins and Waim! Bar, via direct-to-consumer channels with both products immediately selling out, signaling success to impending retail partners.

“We are thrilled to invest in WNWN and be part of their growth journey”, said Elisabet Ålander, senior investment manager, PINC. “This skilled team has succeeded to create a delicious, cocoa-free, alternative to chocolate with a clear B2B value proposition, using traditional and efficient production methods with no regulatory hurdles. In addition, as a sustainability frontrunner, we are also helping the transition of the food system.”

~ Lynda Kiernan-Stone is editor in chief with GAI Media, and is managing editor and daily contributor for Global AgInvesting’s AgInvesting Weekly News and Agtech Intel News, as well as HighQuest Group’s Unconventional Ag. She can be reached at lkiernan-stone@globalaginvesting.com.

*The content put forth by Global AgInvesting News and its parent company HighQuest Partners is intended to be used and must be used for informational purposes only. All information or other material herein is not to be construed as legal, tax, investment, financial, or other advice. Global AgInvesting and HighQuest Partners are not a fiduciary in any manner, and the reader assumes the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on this site.